the-shallot

Jul 1, 2020

Data: https://docs.google.com/spreadsheets/d/1nglUrZAZBuT1xzheSzuHyWO-gwWu_LBSEIGFz51Fl3g/edit#gid=0

Questions from last Shallot:

- Where is microblog growth coming from - specific platforms, specific aliases, higher-priced subscriptions, higher number of subscriptions, low churn?

I was unable to load POWr by Platform for microblog - Hubspot report investigation ->

- Paused users: how many users have a successful transaction after their trial ends

There is not a great way to track these. When looking for events in GA I was unable to attribute a specific event to this and unable to track it vs. goals.

- Which platforms could be candidates for 2 x pricing? Which platforms could be candidates for yearly option only pricing?

Adding to Upcoming Sprint for Investigation

Jun 17, 2020

Look into for next Shallot:

- Where is microblog growth coming from - specific platforms, specific aliases, higher-priced subscriptions, higher number of subscriptions, low churn?

- Paused users: how many users have a successful transaction after their trial ends

- Which platforms could be candidates for 2 x pricing?

- Which platforms could be candidates for yearly option only pricing?

Apr 22, 2020

##Reviews https://share.getcloudapp.com/P8uERryR

Apr 8, 2020

https://docs.google.com/spreadsheets/d/1dZw9rfAFvj9yog7JBoBYE9xtLw8IXxMZQLo8-AlUO7A/edit#gid=0

- Upgrades, Revenue up

- All platforms are growing 20-30%, except for Wordpress and HTML

- All apps are growing, especially popup and Paypal button. Form Builder top of the funnel is down in Wix

- Most apps are trending up in Wix - especially PayPal Button, Social Stream, and eCommerce --> COVID-19-related top of funnel growth

- Transactions are down - seems seasonal, now back to normal

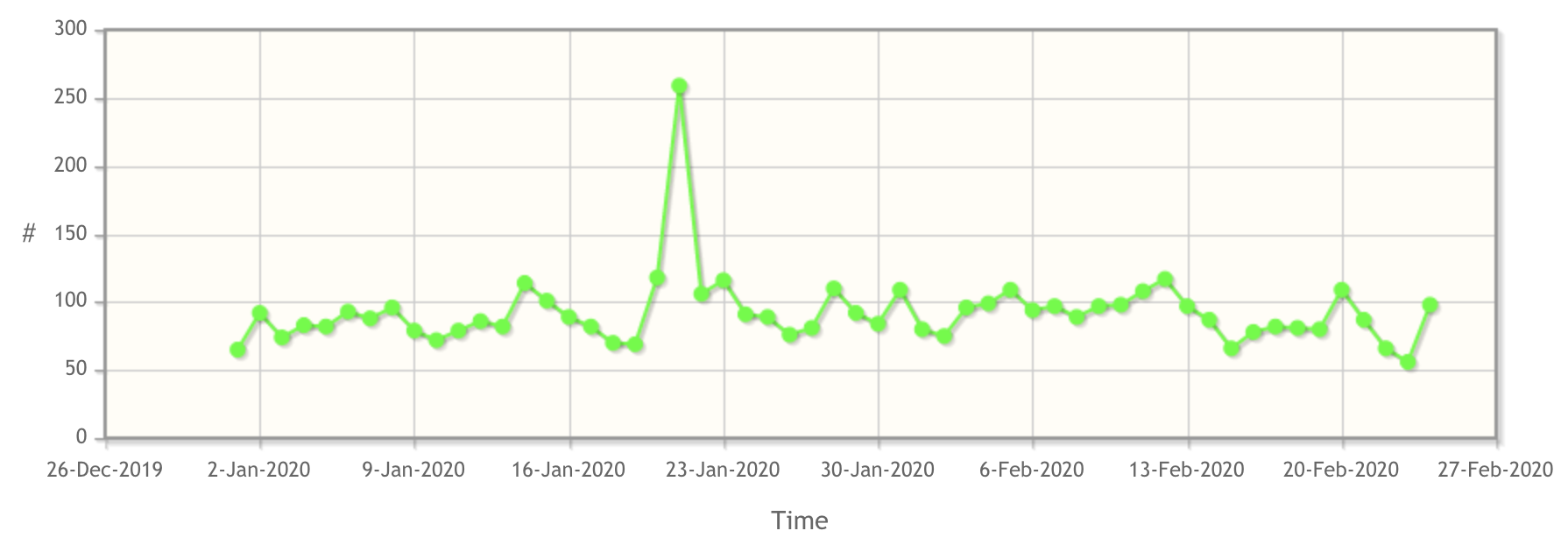

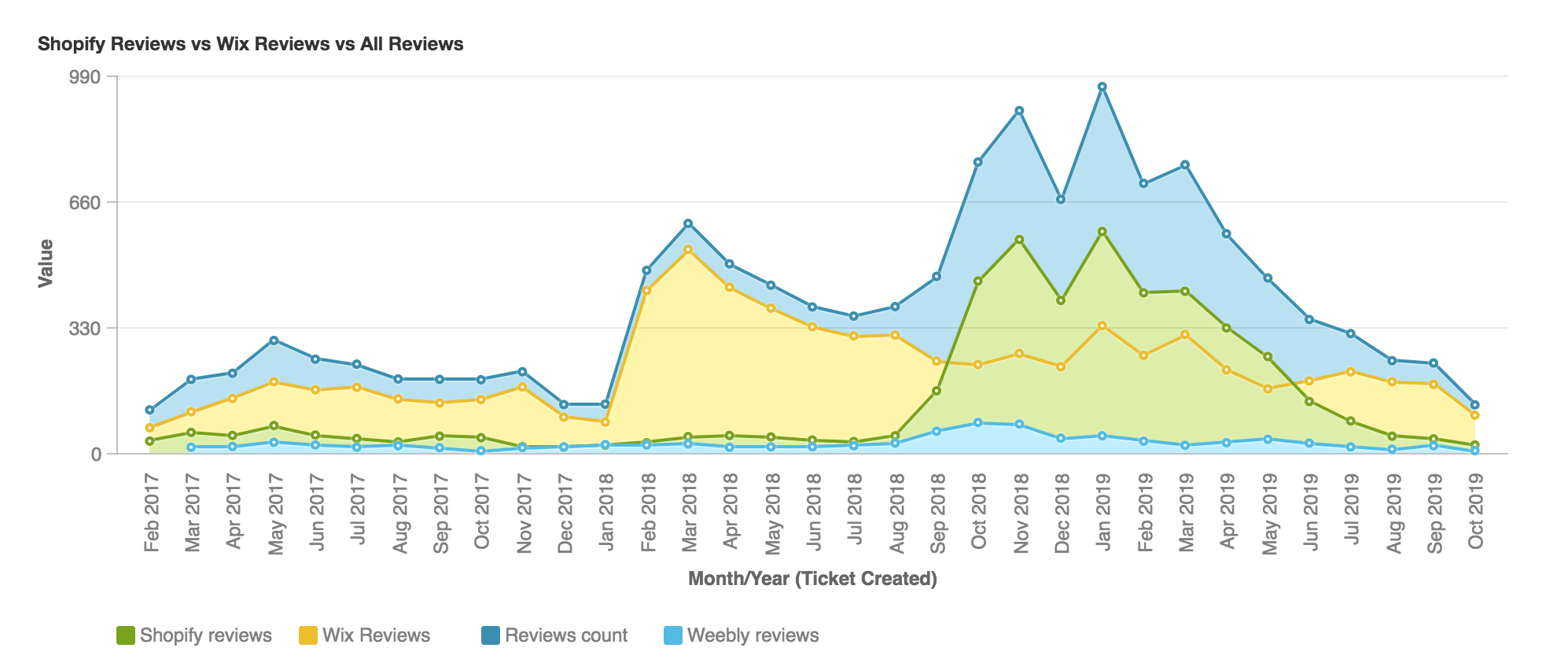

- Reviews are down, but the last week we have a spike, probably due to fixing Wix

- Churn up - cancelations are growing

- Refund requests and disputes: refunds stable, but now getting disputes related to the Braintree fraud incident from Jan 22?

- Customer Success calls: some interesting data from research

- NPS: are we missing out on feedback from paying users? Do we want to revisit this at some point?

March 24 2020

- Upgrades and Rev up, so is churn

- Popup, paypal button, ecommerce seem most dramatically up (corona virus use cases...should we provide better templates?)

- Shopify needs help -> better listings, more reviews

- What is going on in Weebly?

- Soft platforms > $2400 / mo !

- What up with ABs -> https://www.powr.io/admin/powr_ab

Data probs:

- Broken? https://www.powr.io/admin/text-notifications

- What is up with this page: https://www.powr.io/admin/snail-mails

- Unclear what columns wix is included in or not, can we do a better job of communicating this on admin pages?

Q for next Shallot - When does Last Viewed URL for popup get captured, is it immediately on most platforms? (Steph)

Feb 26, 2020

Follow Ups:

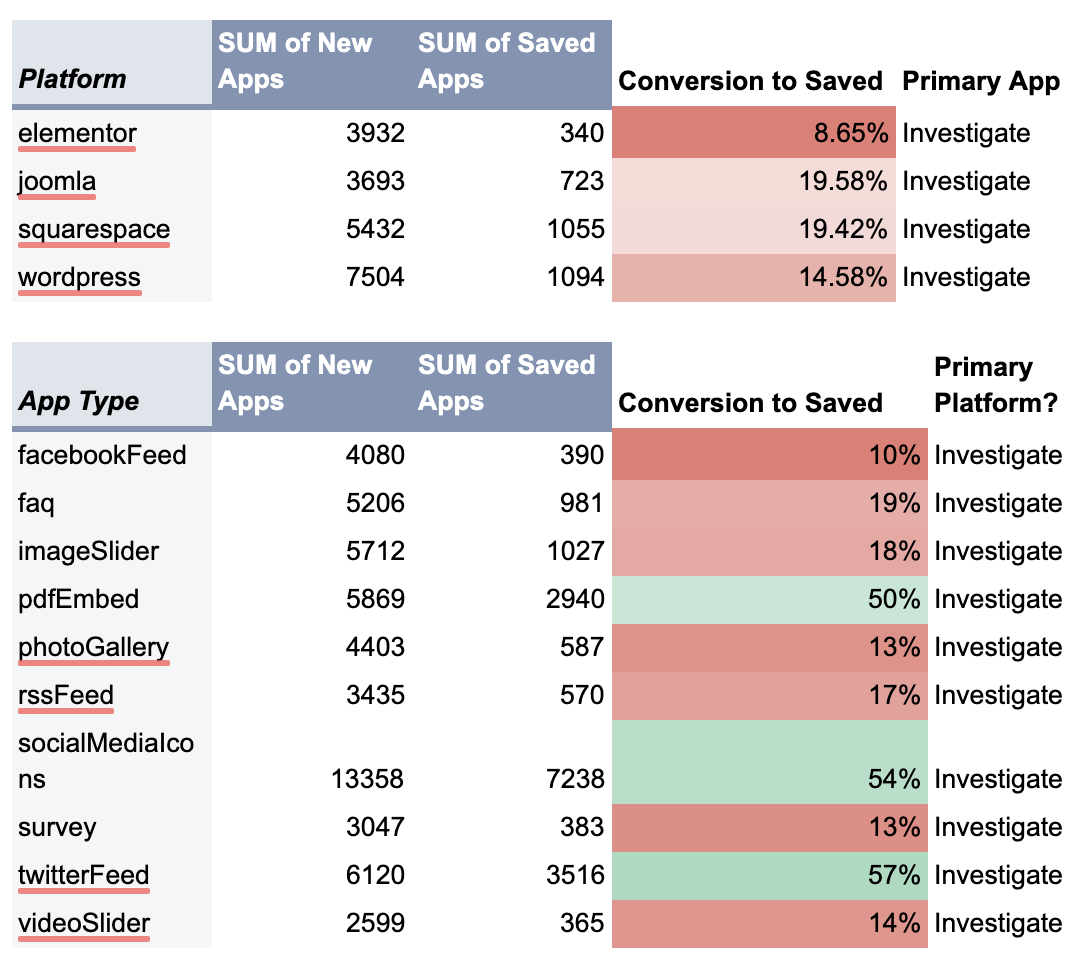

- Teddy to investigate powr-by-platform and -by-app further - low conversion rates and questions/hypotheses

- Beks to look into churn research outcomes - popup churn and social feed upgrades from users that do not have a social feed

- Ivan to work with product team to understand the low LTV for Shopify apps as documented in this thread: https://powrteam.slack.com/archives/C8Y21A4KS/p1582685723016300

- New designs to get more reviews are being implemented this sprint (no change on Wix) - check on results

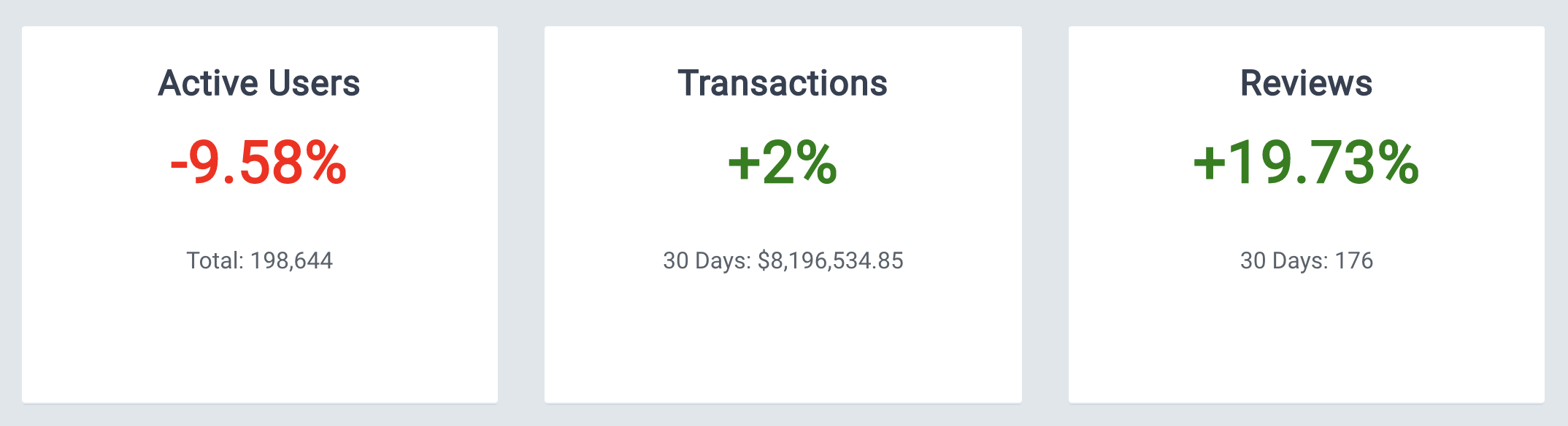

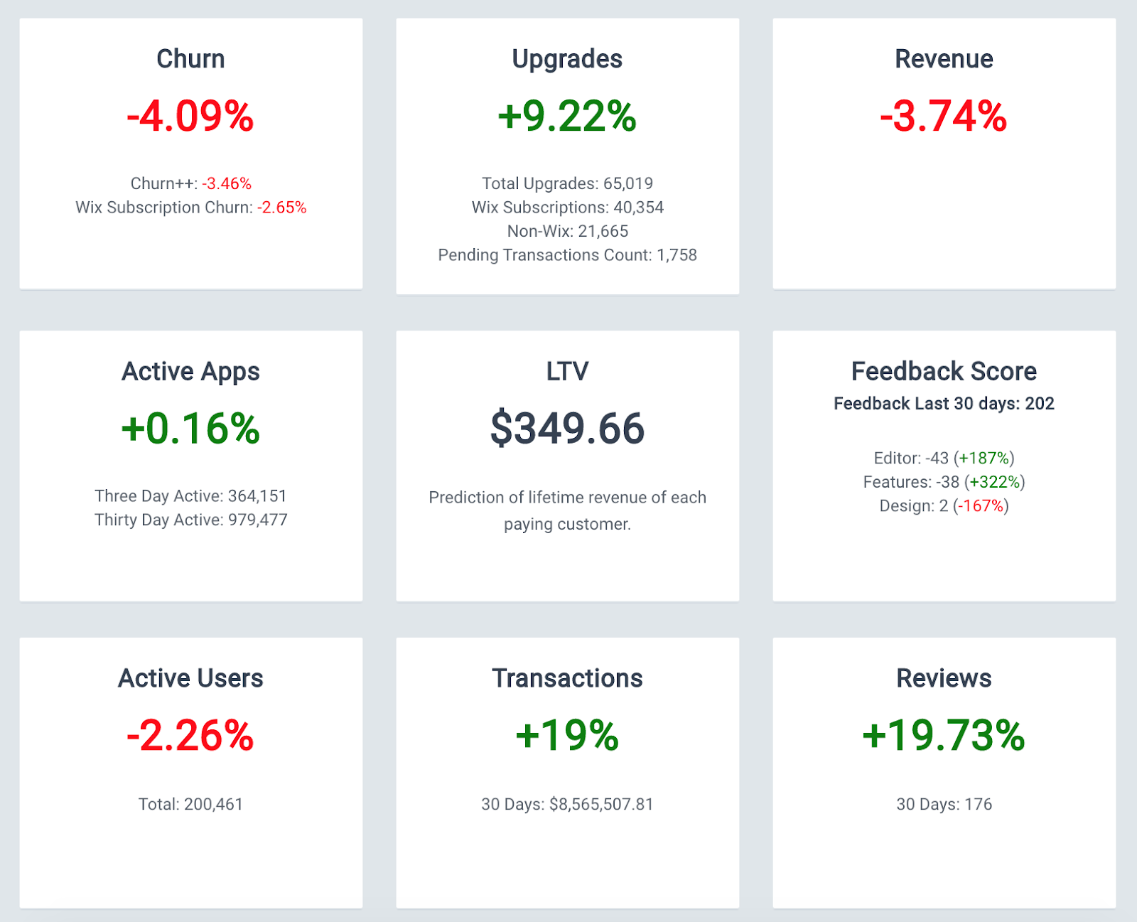

Company KPIs:

No sharp changes in numbers since last shallot, except:

-Less upgrades (+24% 2 weeks ago) - ?

-Less reviews (+20% 2 weeks ago). Probably spike after promoter emails launch is trending down now.

No sharp changes in numbers since last shallot, except:

-Less upgrades (+24% 2 weeks ago) - ?

-Less reviews (+20% 2 weeks ago). Probably spike after promoter emails launch is trending down now.

Reviews

powr-by-platform, powr-by-app (daily and raw)

https://docs.google.com/spreadsheets/d/1q1NVVsdn_-ZvFQZ2B5S7HFvQQnhprOd3bqVE2VSdnTY/edit#gid=0

https://docs.google.com/spreadsheets/d/1q1NVVsdn_-ZvFQZ2B5S7HFvQQnhprOd3bqVE2VSdnTY/edit#gid=0

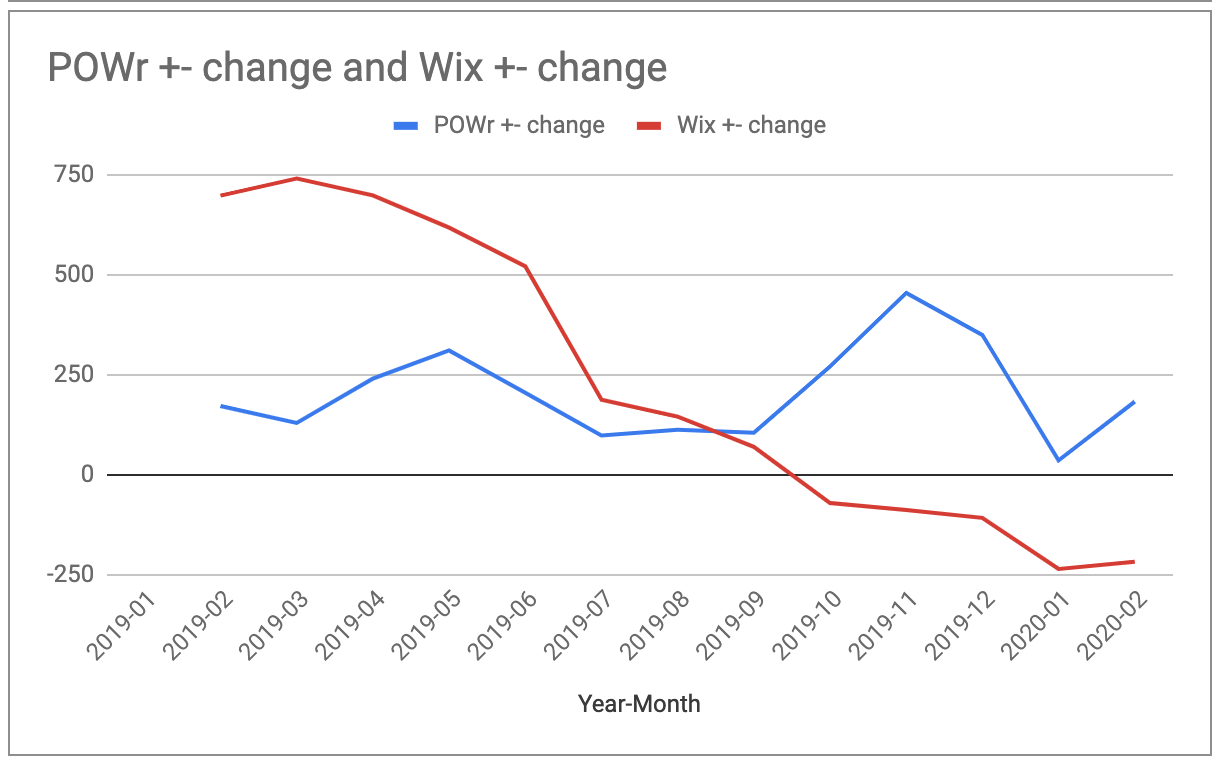

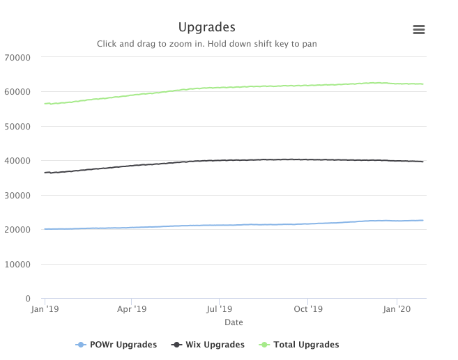

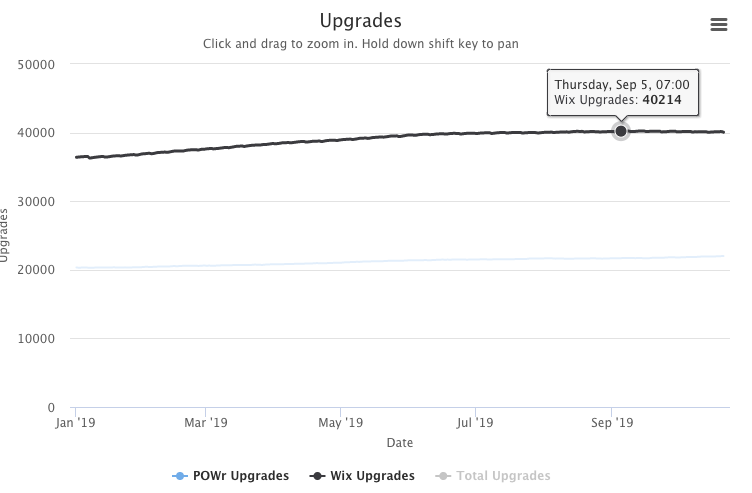

Upgrades:

Important dates for upgrades Maximums:

- 2019-09-14: Maximum for Wix Upgrades

- 2019-12-13: Maximum for Total Upgrades

- 2020-02-22: Maximum for POWr Upgrades

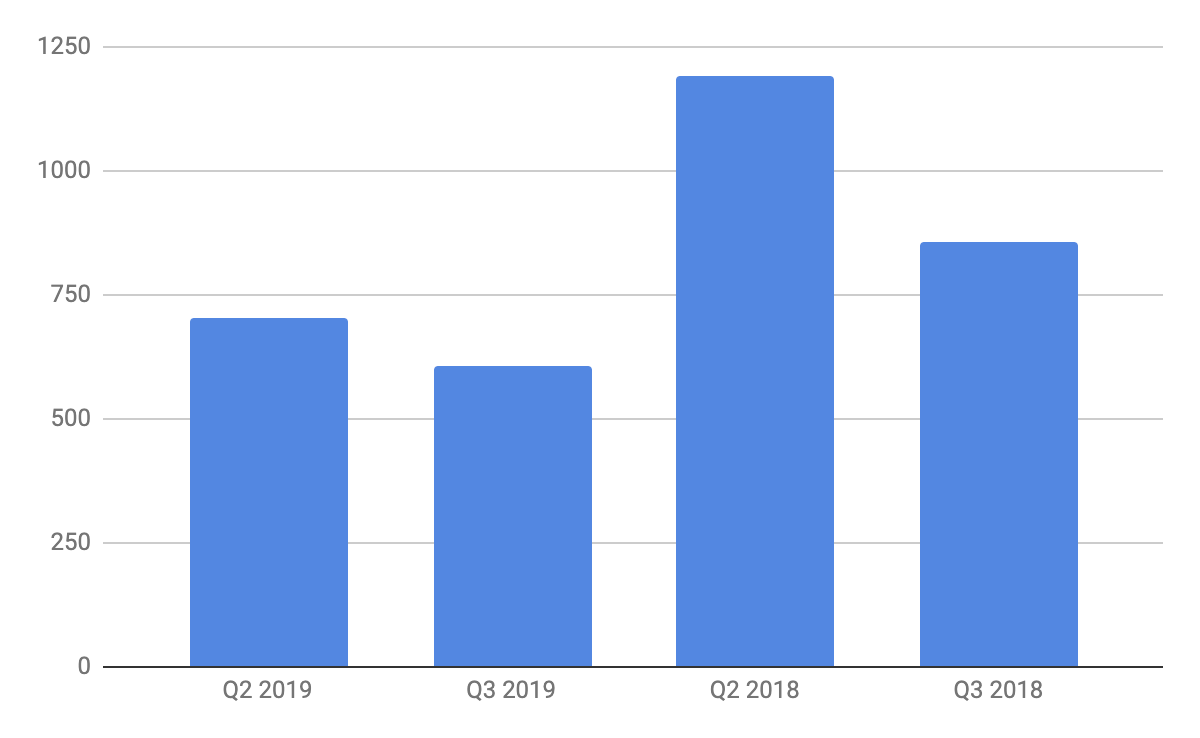

July 2019 - Second weakest growth for POWr total upgrades AND beginning of sharp decline in Wix total upgrades

November 2019 - highest growth for POWr total upgrades

January 2020 - lowest growth of total upgrades for every month since January 2019

February 2020 - POWr total upgrades growth trending up again

Followups from last time:

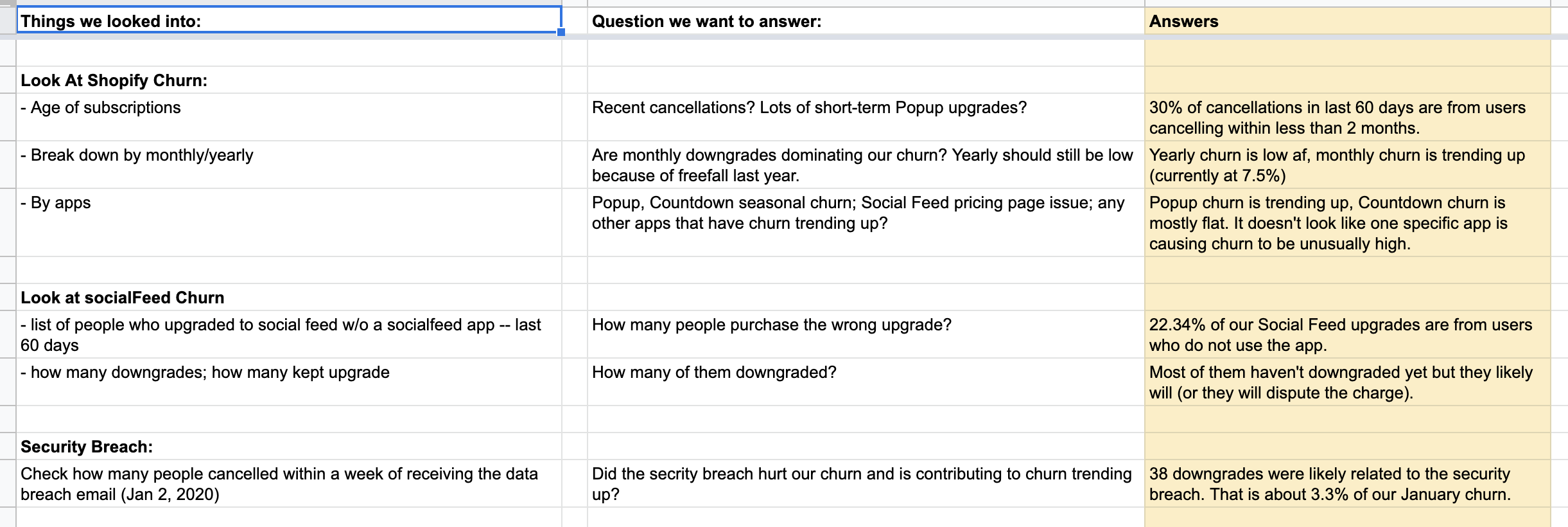

- Ivan and Pilar looked into churn:

https://docs.google.com/spreadsheets/d/1f1j4BpNROUrQOlXYtv33LogegvjatQGBgPuGpEUWAds/edit#gid=1231789893

https://docs.google.com/spreadsheets/d/1f1j4BpNROUrQOlXYtv33LogegvjatQGBgPuGpEUWAds/edit#gid=1231789893

Feb 12, 2020

Action items:

- Pilar and Ivan to dig into more into churn spiking up.

- Ivan to remove spam form apps from powr-by-app.

- At least 1-2 accidental upgrades for Social Feed because we're defaulting to that on the pricing page. What can we do about this? Emilie to address in next sprint.

Reviews

- Spike when Promoter email funnel launched, and are trending back up. Chelsea is looking into designs for revised flow this sprint:

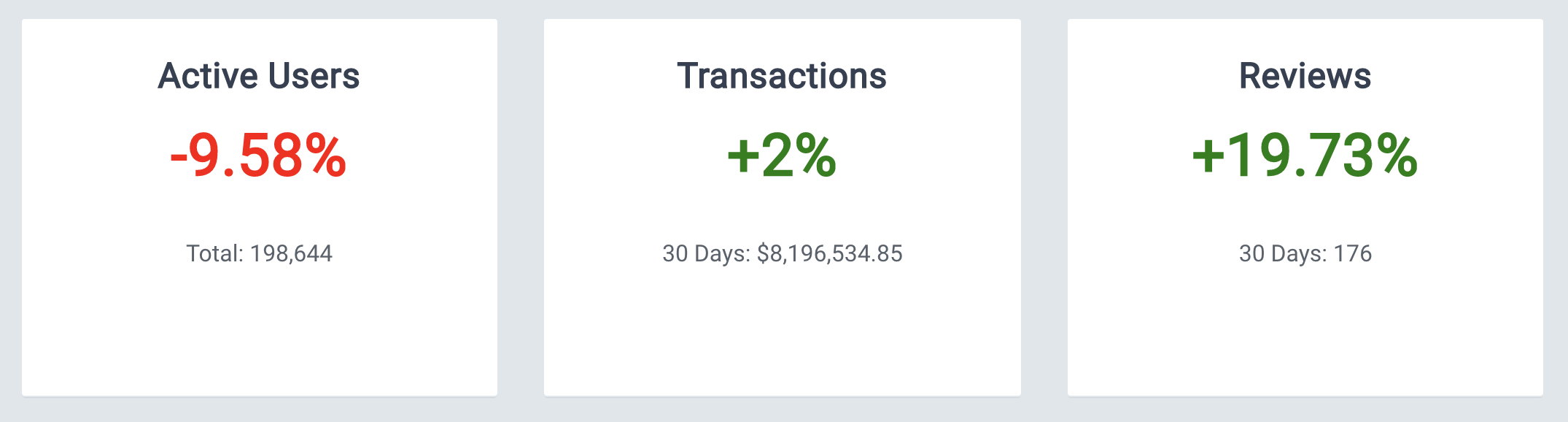

Company KPIs:

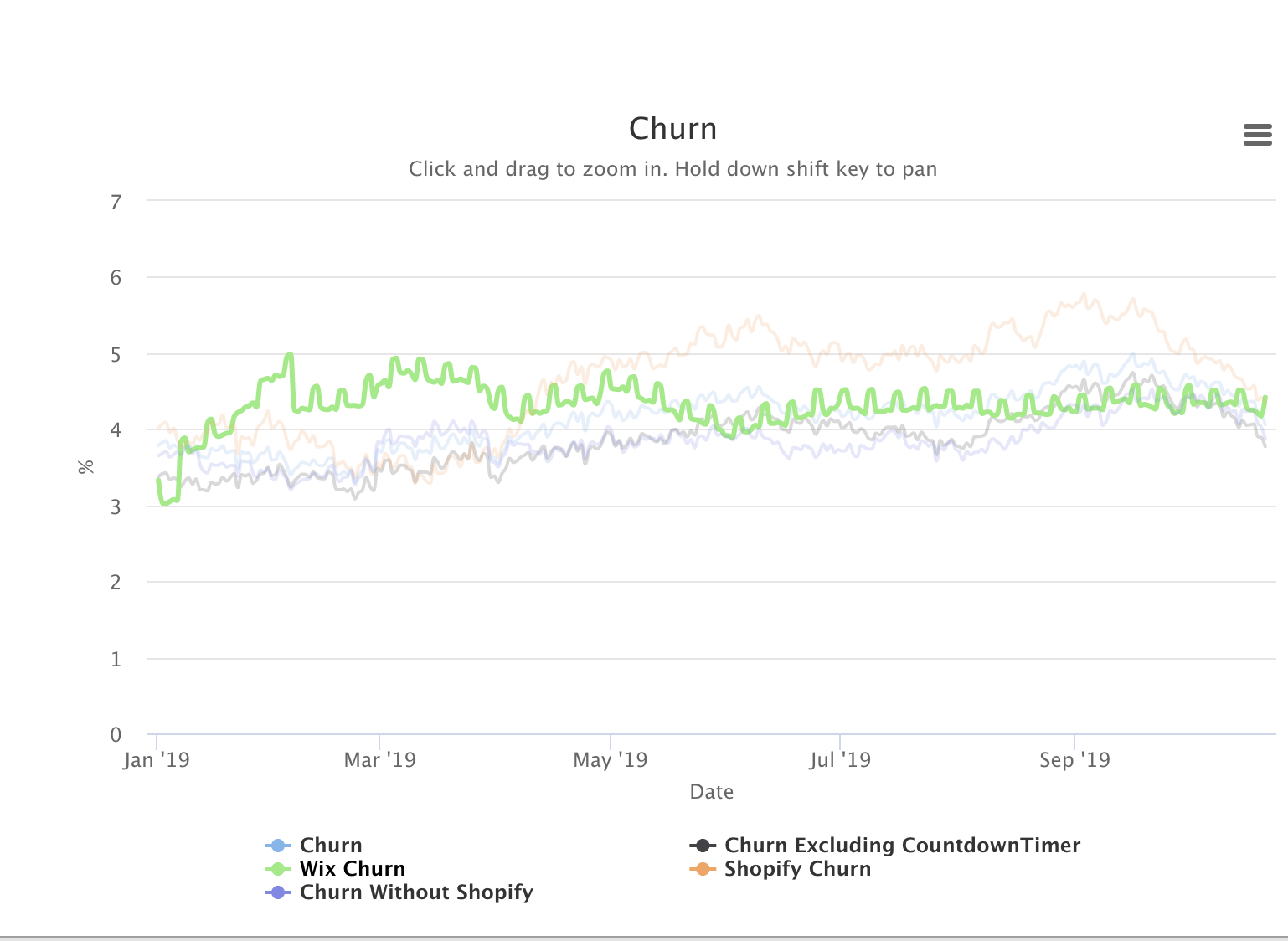

Churn:

- Trending up slightly - is there anything else we should look into here?

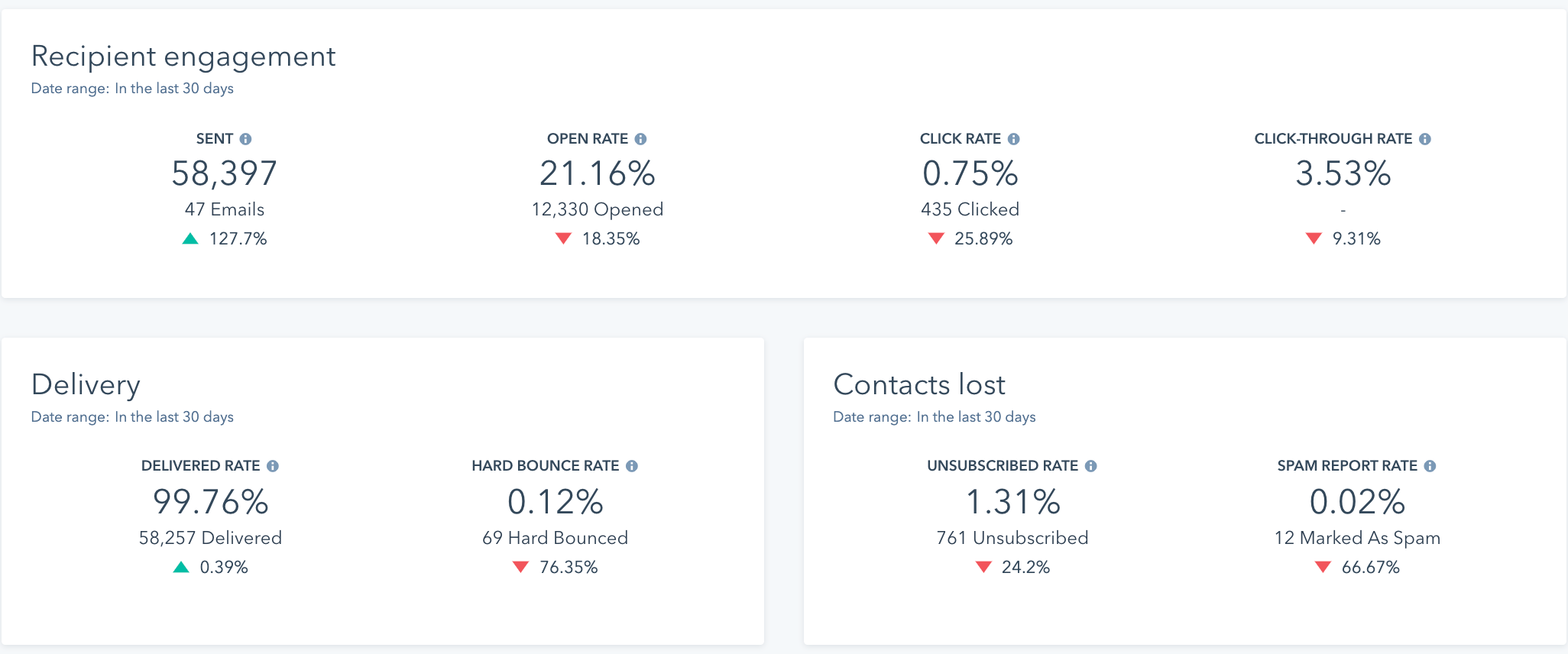

Email Performance:

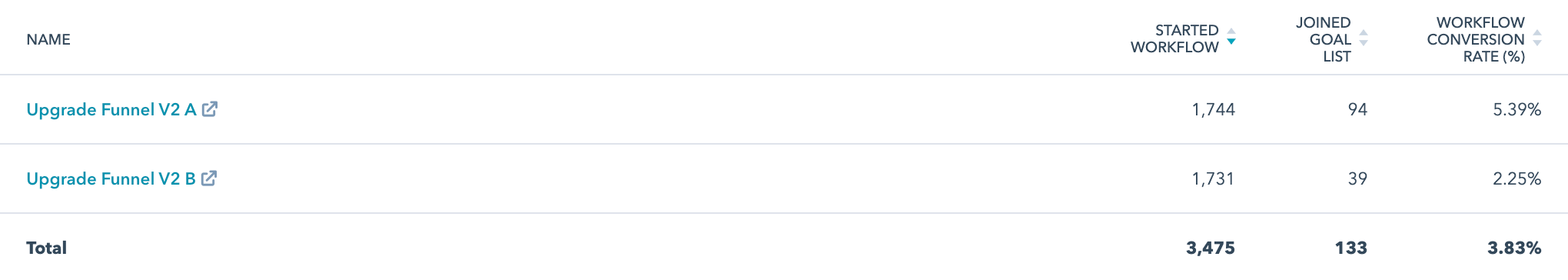

Top 4 Performing of 16 funnels Form Activation - 31.58% Goal Completion General Activation - 20.42% Goal Completion Wix Gen Activation - 19.64% Goal Completion Cart Abandon - 19.15% Goal Completion

Full list of Email Performance on Google Docs Below

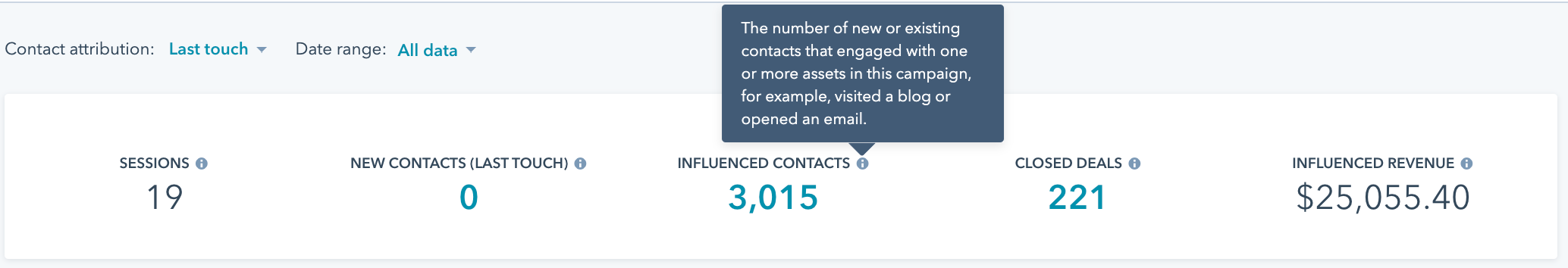

Upgrade Funnel Influenced Contacts Metrics:

Influenced LTV Metric (See Google Doc)

Other Related Information: https://docs.google.com/spreadsheets/d/1lNIItE0johAHw4hQjLsiw0mm2KK0GJ6OLH1KKUmOmB4/edit?usp=sharing

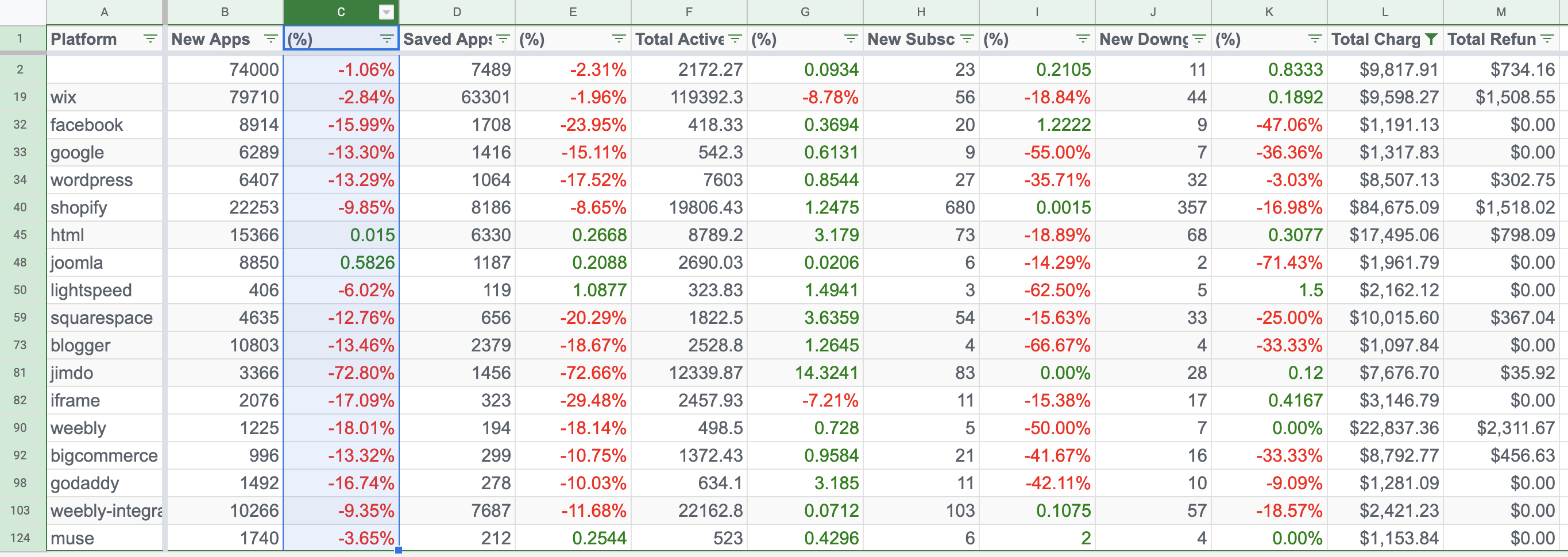

powr-by-platform

- Almost everything is green - expected when comparing January to December.

- Shopify new subscriptions are up +29% and monthly revenue up 10.5%.

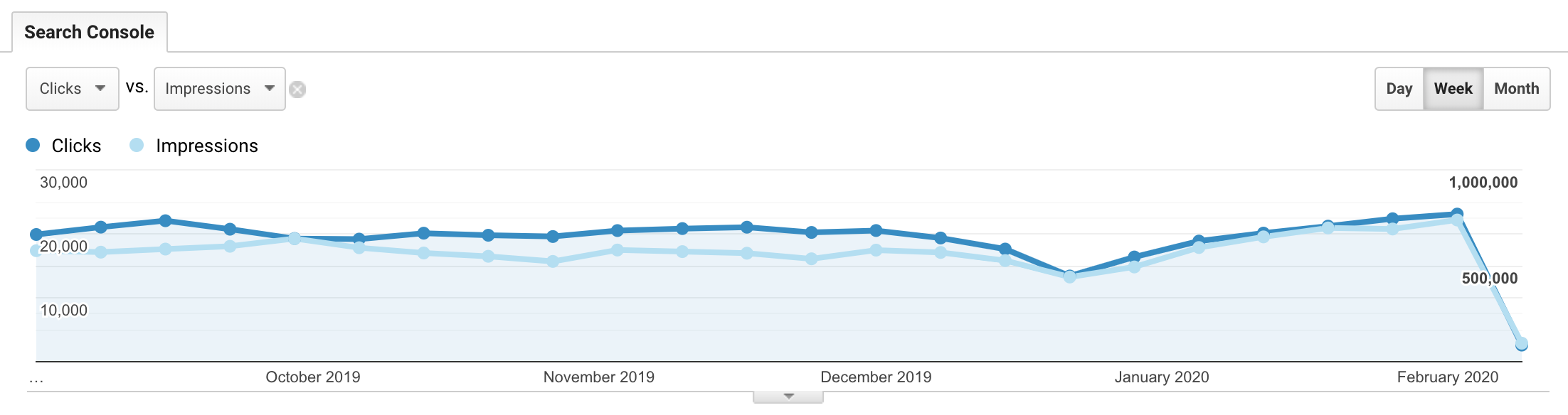

Organic Search

- Organic search is trending back up again. We're not sure why, but Steph and Emilie jamming later today on whether this is isolated to a particular subset of pages or if it's across the board.

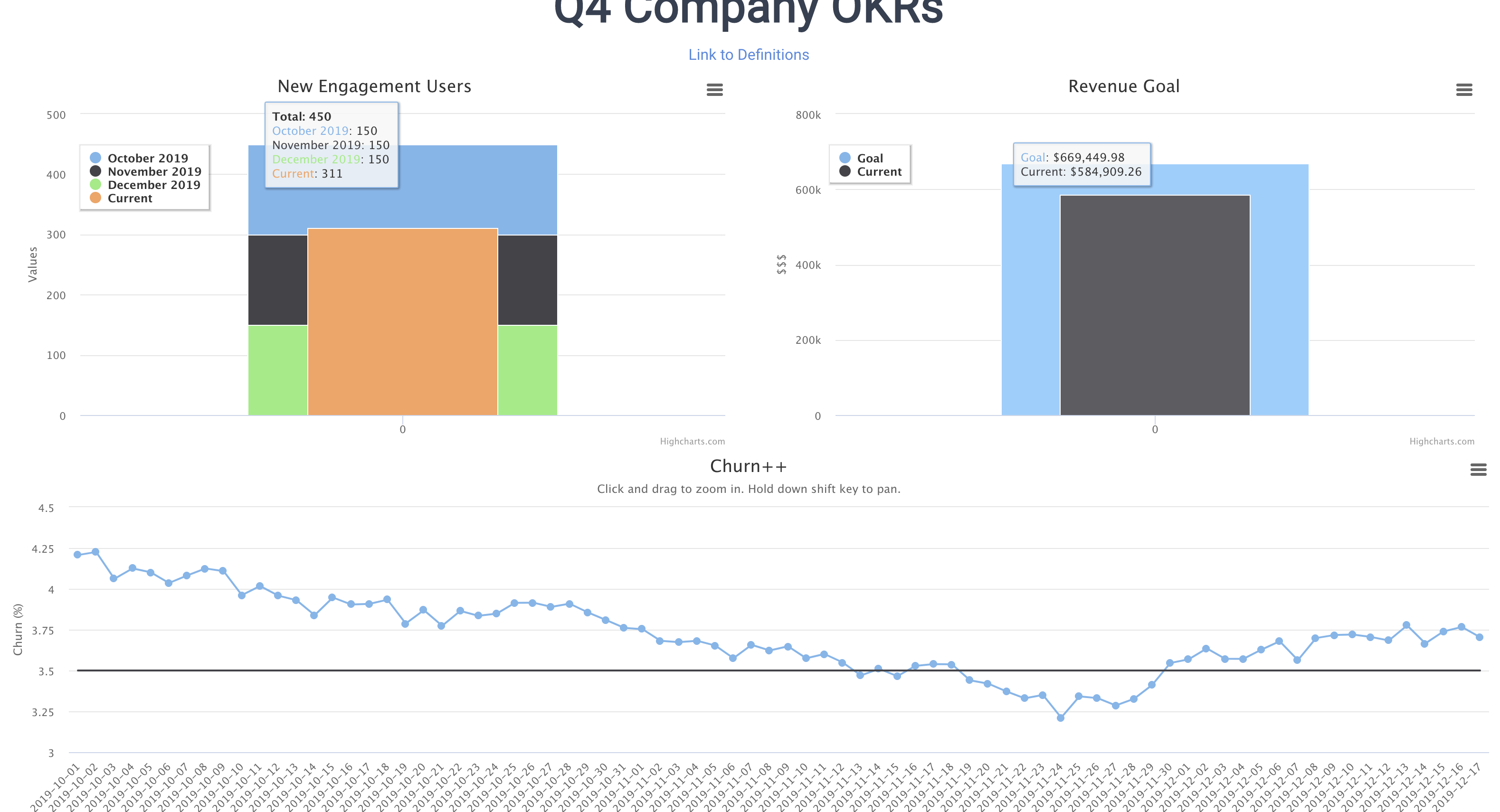

OKRS

- Flat

Jan 29, 2020

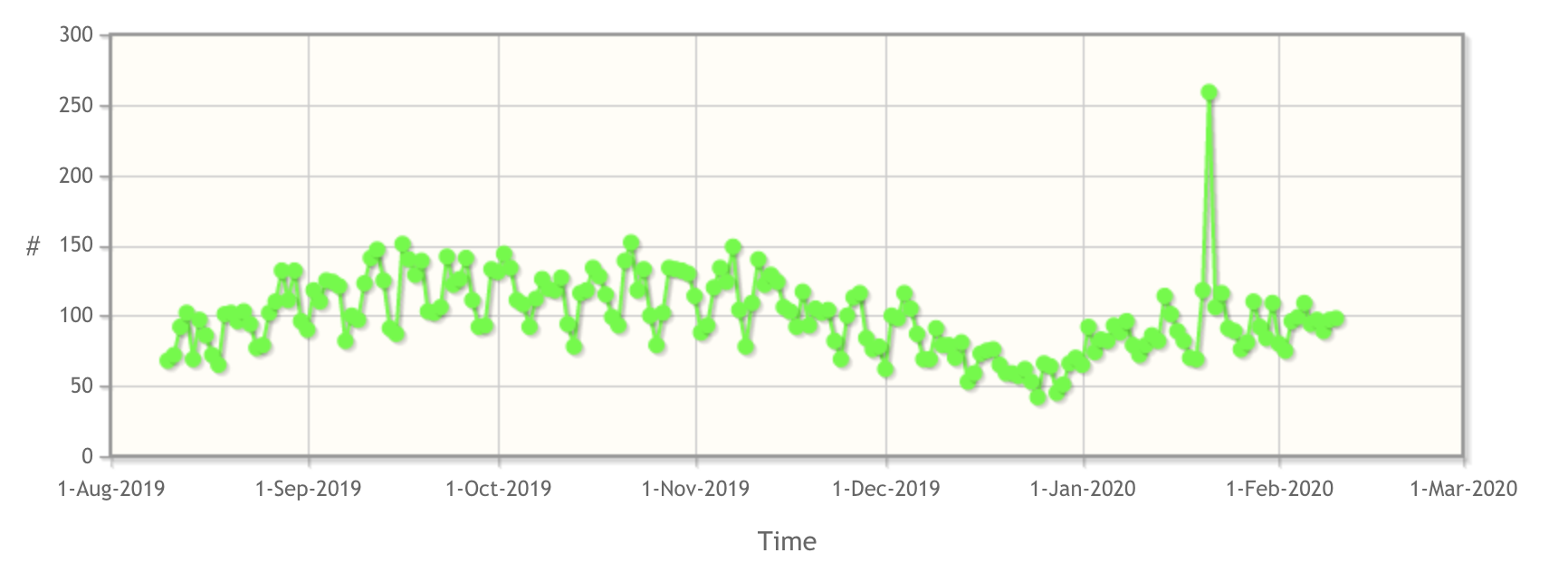

Beks:

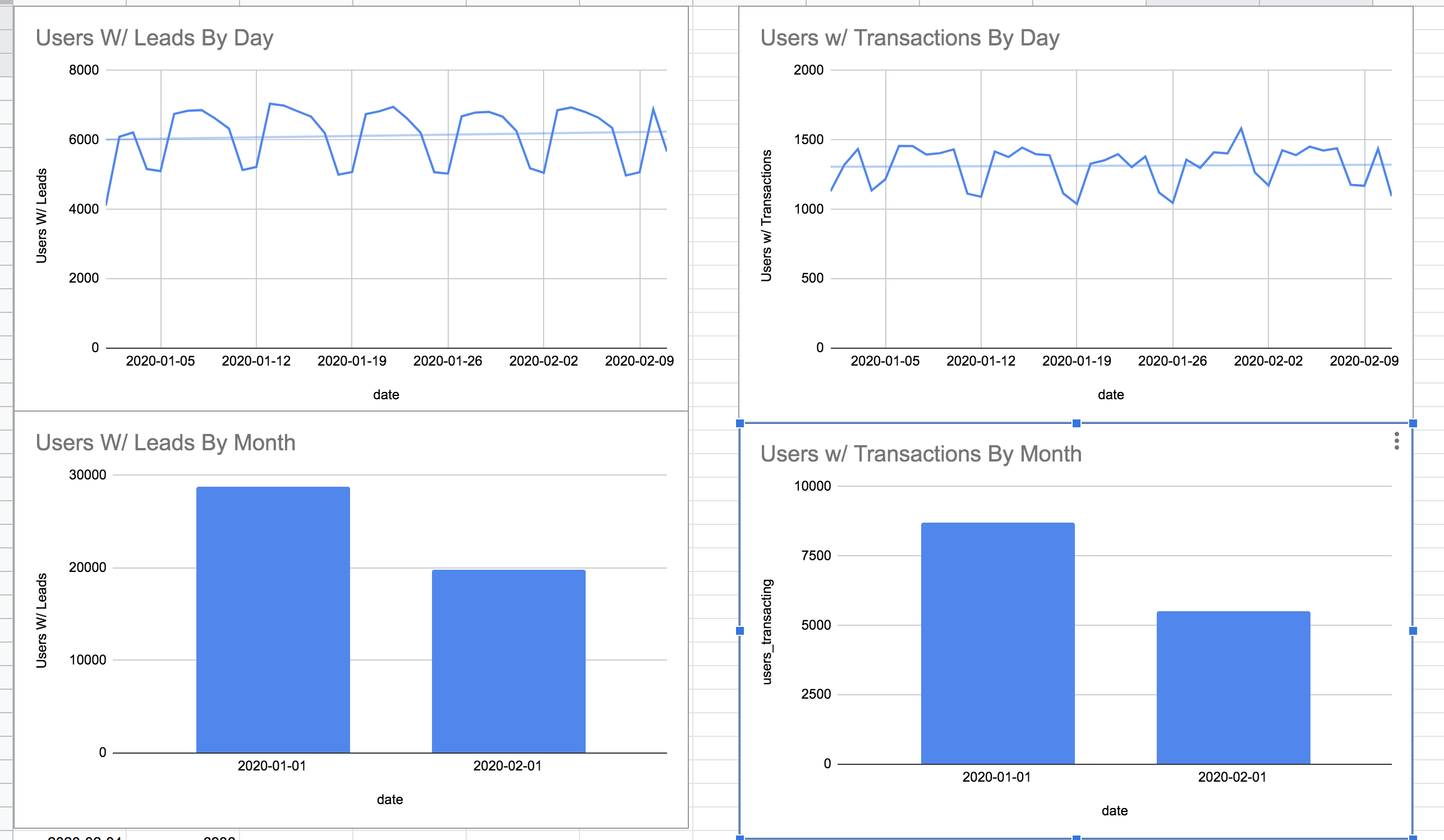

Numbers

- Upgrades +9.22%. Is it total or new? If total +9% seems huge

- Transactions and Reviews are up by 19%. Transactions were down in December.

Powr by platform

- Most of the platforms are flat

- Weebly top of the funnel declining (-8.81% in saved and -17% in URL exists). It has been always declining?

New apps on Weebly:

- HTML top of the funnel declining. It was growing before. GA users -7% the same period

New apps on HTML

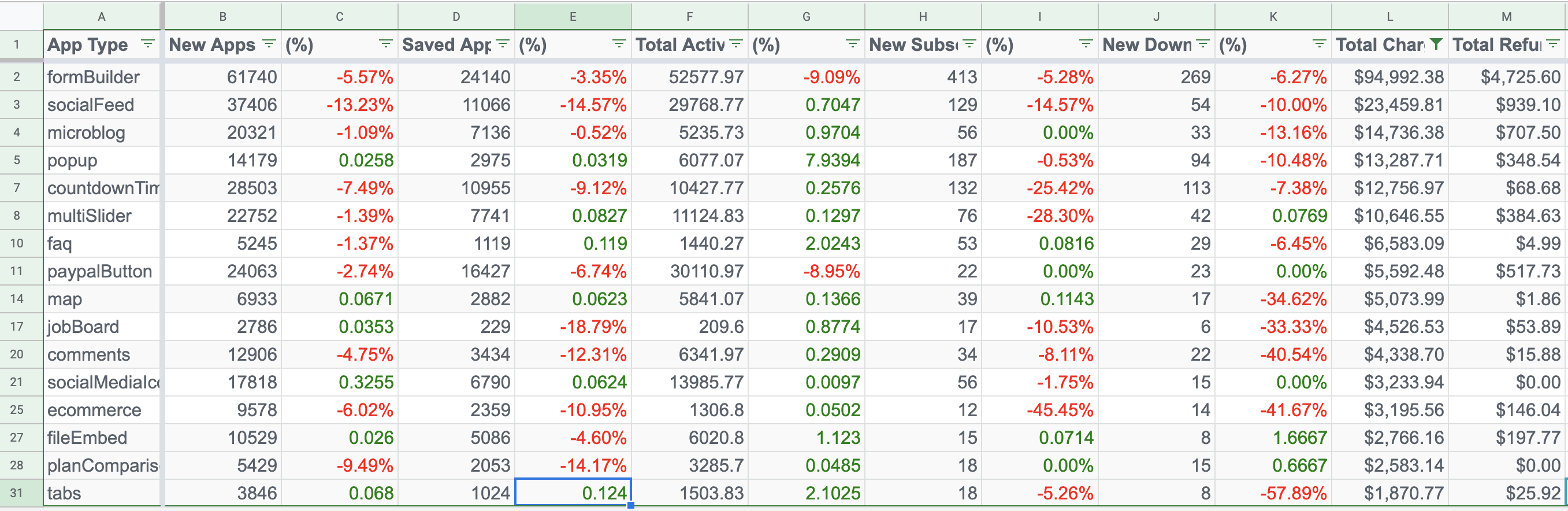

Powr by app

- Most of the apps are flat

- Popup top of the funnel 18% decline - last year January was higher than December. New subscriptions -30%

Popup new apps:

- File embed top of the funnel 18% decline

Pilar:

- Shopify pageviews + installs: how much are ads hurting us?

- It seems like it's primarily our top apps that are doing poorly - Form Builder, Countdown Timer, and Photo Gallery are nowhere near the volume they used to be

- Smaller apps with less competition are still doing great, e.g. FAQ, Map, etc.

- Need to look into: why is Sales Pop not making us any money?

- Countdown Timer has gone from being by far our most popular app listing to not even being in our Top 5 apps anymore (even FAQ gets more views)

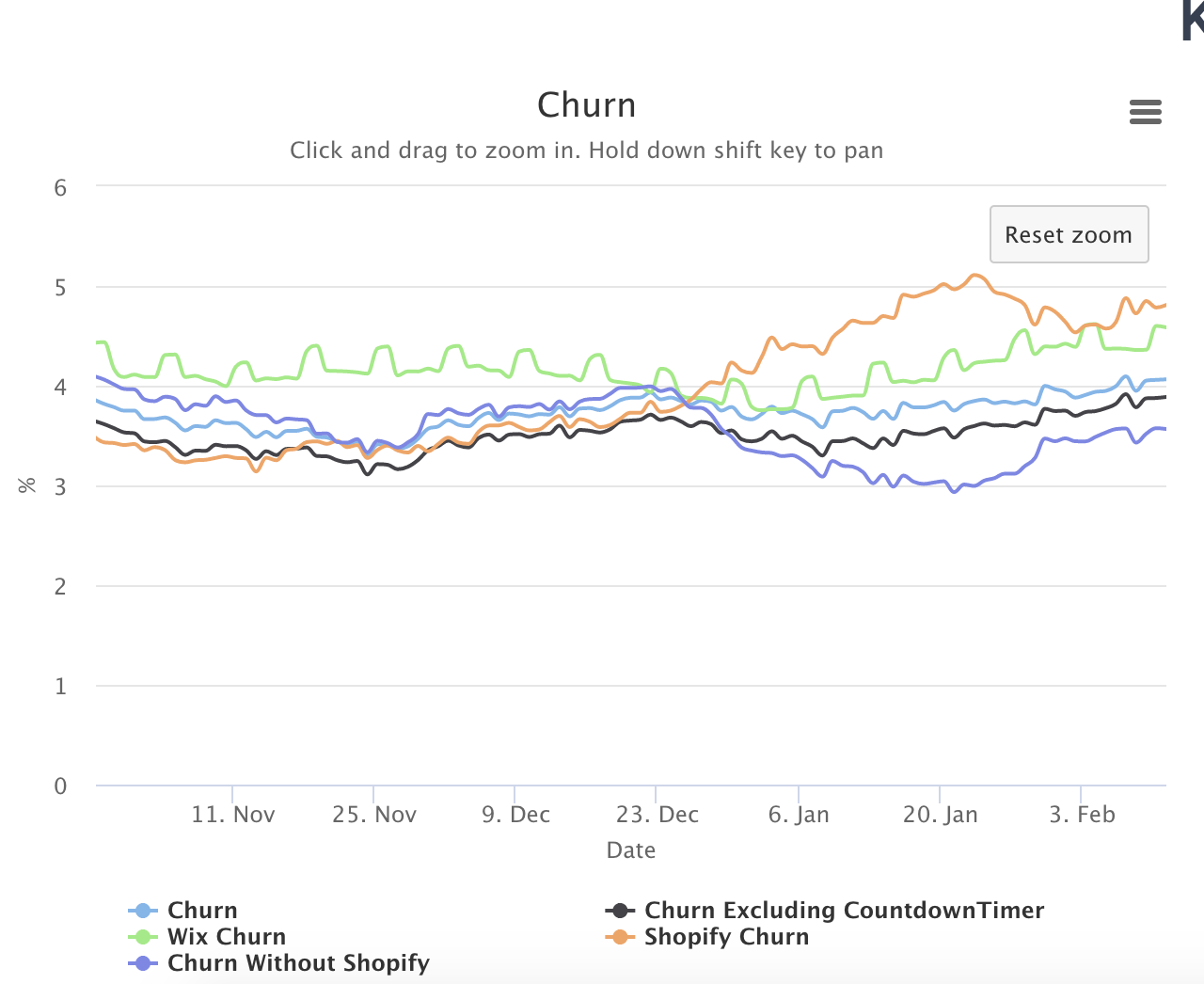

- Churn trends 2020 so far

- Our churn without Shopify is looking fantastic (3.07%!) - is this real? Nothing weird in cancel feedback, we get downgrades with all kinds of reasons, and we have very few pending transactions; Countdown Timer not being massive anymore seems to be helping.

- We still think Shopify churn was looking good because of few downgraded yearly subscriptions due to Freefall last year, data in below Shallot sheet somewhat confirms that

All data: https://docs.google.com/spreadsheets/d/1C-2Xu7WMVipHNaxVnA_eVAvhMuEM39XiO-6zY3bHEmA/edit?usp=sharing

Notes:

- Our data was fucked because of Braintree spam

- Squarespace is going to have a Superbowl commercial again this year. Looks like Wix won't 😕

- platform being a random number: identified issue with search in mini market adding a random platform={number} to URL, causing some of our platform-related data to be jank. Ivan will be fixing in current sprint.

Followups from last time:

- Emilie's team owns reviews - actively being worked on

- Split A/Bs - we think they're legit. Follow-up is to re-think defaults and templates. Pilar is organizing some of Chelsea's notes on past A/Bs. We need design interns to work on these.

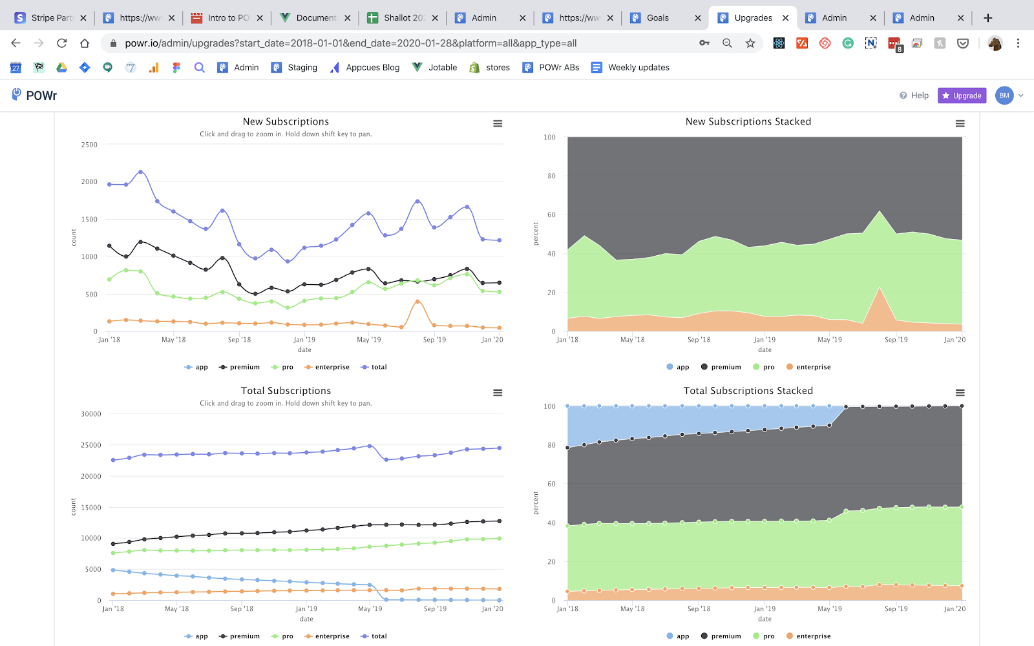

Jan 15, 2020:

- December was an unusually shitty month

- Overall subscriptions has been slowly but steadily climbing apart from dec

- Long tail list of platforms seems to be growing

Followups:

- Reviews are still tanked from a year ago. Emilie + Pilar + Ben scheduled a meeting to take action.

- Ben is looking into split ABs to see if they are garbage or legit

- Pushing Shopify harder on why ads are killing us: Josh + Victory

Dec 18, 2019:

- Numbers page was previously broken - 30 day numbers may be erroneously based off of values of 0

- Churn has leveled off and continues to decrease (good)

- Revenue gap continues to increase through the holiday season (good)

- Wix total upgrades continue to decline (bad)

- Total upgrades continue to increase (good)

- Growth in POWr upgrades outpacing loss in Wix upgrades (good)

Follow up from last time:

- Look at form top-of-funnel numbers over time. It keeps looking like these numbers are down, but is this a consistent trend or is it oscillating on a short period?

- Why Squarespace grew?

- Why HTML going down? (are these Squarespace users that are following a different behavior? Could account for both)

- What happened to Wix revenue in August and September?

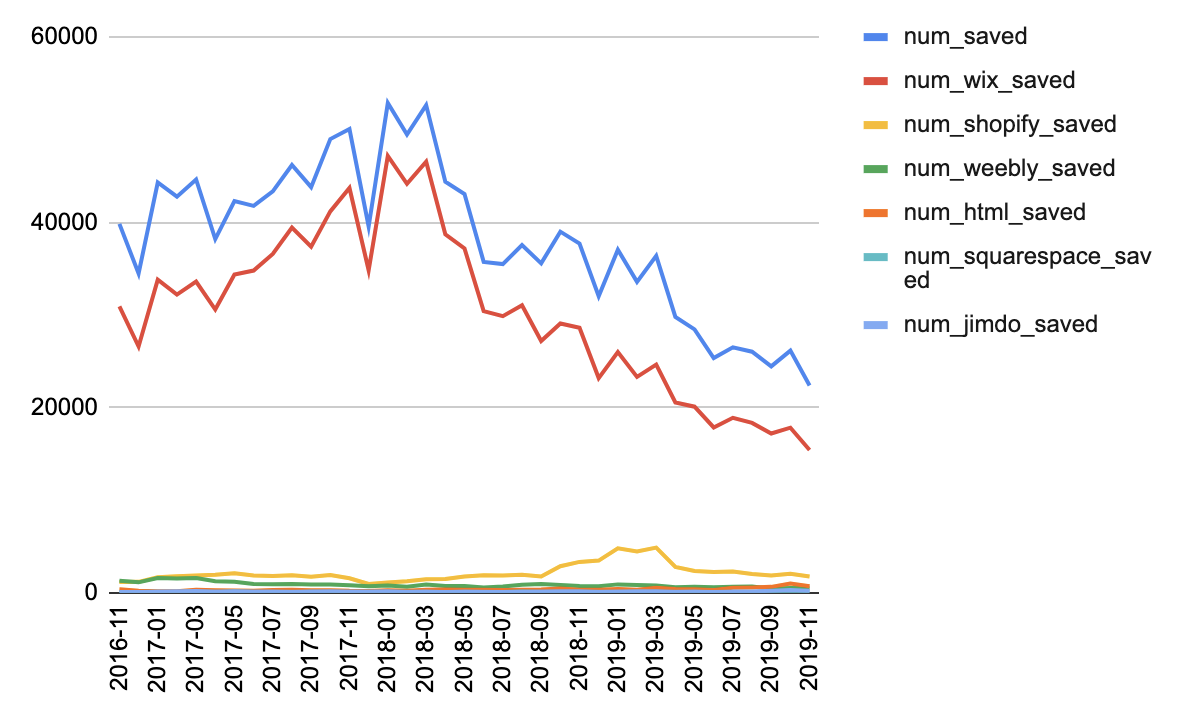

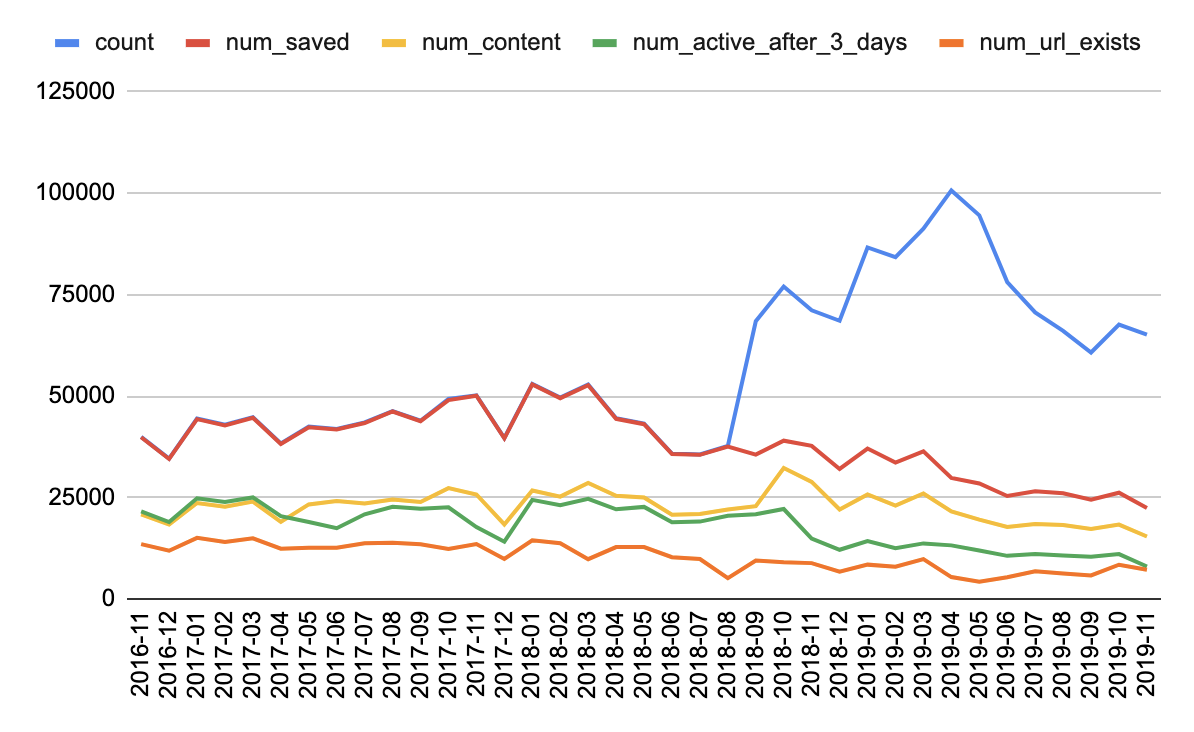

Form Top of Funnel over time

- link to sheet https://docs.google.com/spreadsheets/d/15boj9e7cugTVo6jeKQG4219UUT08HnS1airWrxYeY5o/edit#gid=1931465322

- Large decline in Wix Form Builder apps created beginning March 2018

- Saved, with content, and active after 3 days all declining since October 2018

- URL exists increasing since May 2019 (better tracking?)

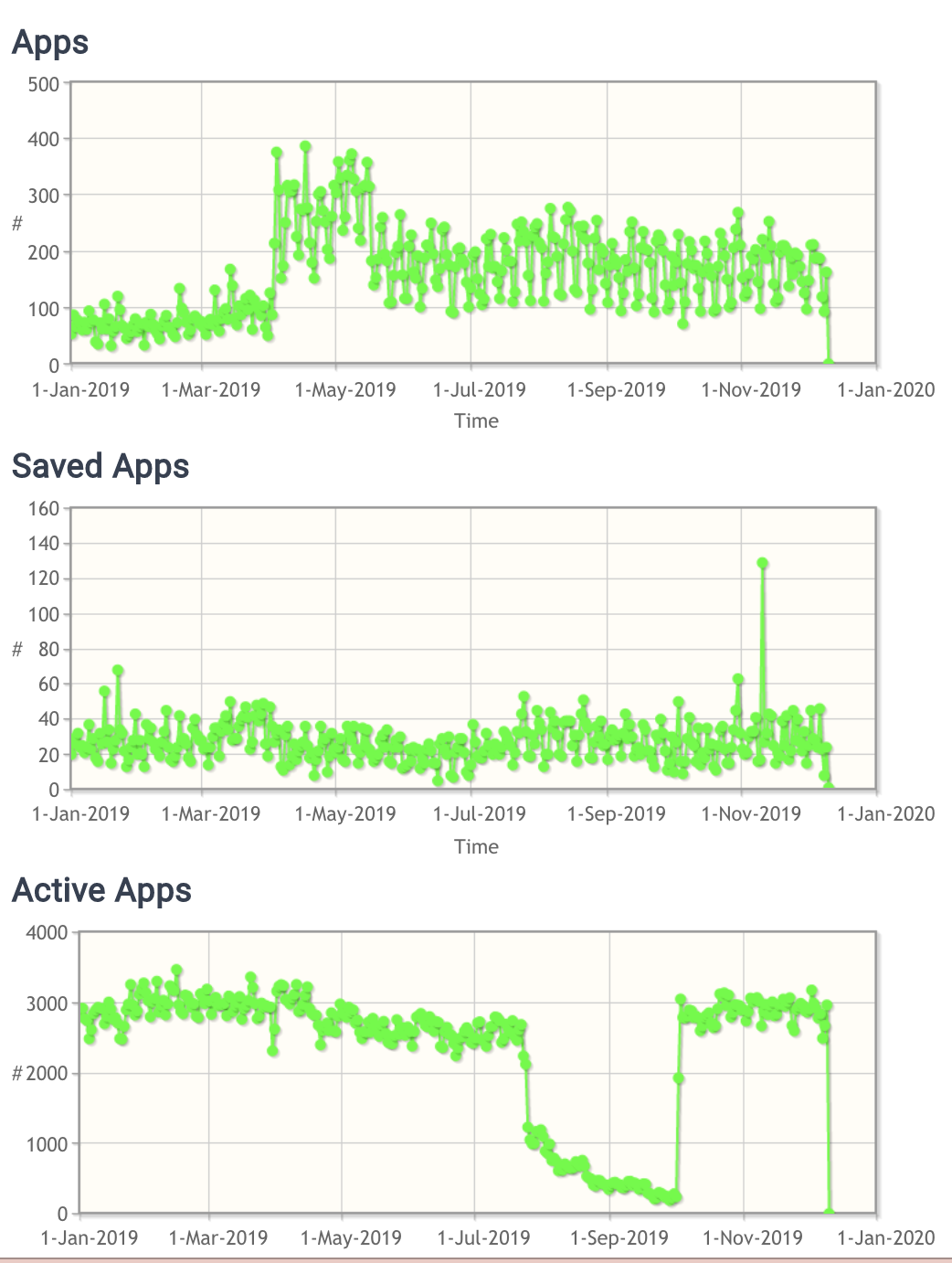

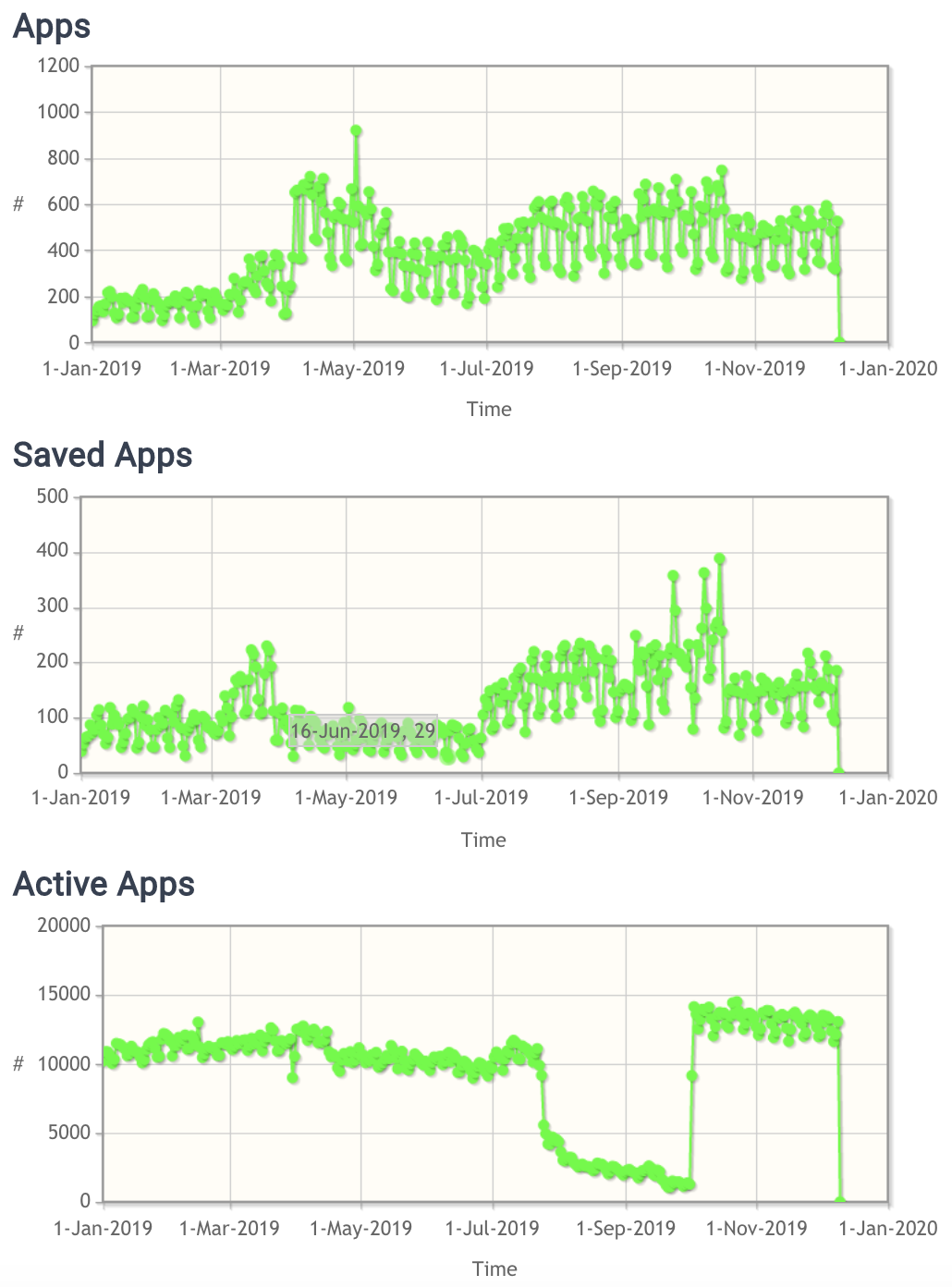

Popup Top of Funnel over time

Squarespace growth

https://app.impact.com/secure/mediapartner/report/viewReport.report?handle=mp_dashboard

HTML going down

Dec 4, 2019:

Follow up from last time:

- Pilar will set up a Zendesk trigger to send these updates to Slack: https://www.wix.com/release/notes/new-features

- Why Squarespace grew?

- Why HTML going down?

- Replace NPS with Feedback from Standalone

- How people come from Wix to Powr

- Wix users missing deleted at timestamp in their apps

HubSpot open rates are looking great for some campaigns: Form activation: 41.4% <--- AMAZING! General activation: 26% <--- good, but shows personalized content works better overall Upgrade: 25.64% <--- good rate, but room for improvement Retention: 100% <--- but only 6 sent so far; looking into Cart abandonment: Only just fixed, too soon to tell

Goal completion rates are low (but also emails haven't been running for long): Form activation: 1.88% have a URL General activation: 1.91% have a URL Upgrade: 0.22% have upgraded (but they enter this funnel later, need more time)

Black Friday promo upgrades (Nov 20-Dec 2, 2019) vs. previous period --> For subscriptions that used 40_off_1_year: Subscriptions for promo period: 330 Subscriptions from prior period: 92

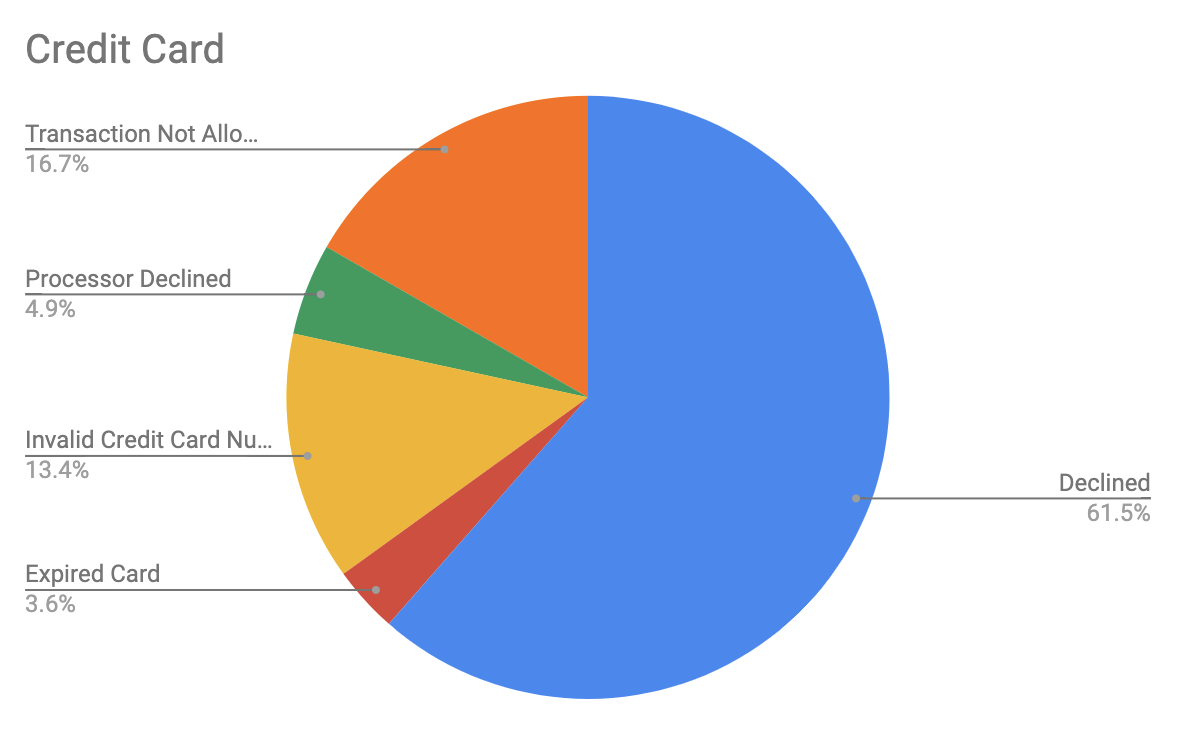

Failed payment reasons for November:

Numbers:

powr-by-platform: https://docs.google.com/spreadsheets/d/1Y4BSceh0y1268CimN5nz4Lokqf1UE88YQ8KThDEvSYg/edit#gid=0

- Same trend for Squarespace going up and HTML down <-- need to look into

- iframe revenue up 46% (??)

- Shopify new subs up 15.5% <-- Black Friday promo?

powr-by-app:

- Popup still crushing it

- Countdown Timer new saved apps up 12.5% (as expected).

Side note:

- https://www.powr.io/admin/snail-mails is broken

Nov 20, 2019:

Beks:

Admin/numbers Reviews are up

powr-by-platform Ever active is down everywhere, new subscriptions is not down Squarespace top of the funnel growth by 40% - where is it coming from?

Pilar:

- Refunds: what's result of Waylon's test?

- powr-by-app

New saved apps down across the board, except Popup Popup totally crushing it, new subs still up by 30% - revenue now at over $14k/mo, conv. to paying among the highest now Form Builder pretty flat, why is conv. to saved so low?

- NPS:

With new system, we're only getting VERY few ratings (7 per week vs 99 per week before)

- Search Analytics

Wix is most searched platform - why are we sending so many Wix users to powr.io? Doesn't make too much sense. Mini Market: no one goes to the mini market to discover plugins? Wobblies seem to be using the sidebar links instead, and/or "Recommended" and "Recent". Mini Market: what are people looking for when they're searching for "blog"? 🤔

- Wix numbers: Ben, Emilie, and Pilar + Data School team are looking into funnel

Seems like we are losing people to of the funnel but also not pushing people to yearly as much anymore because of the new package picker. Still looking into individual apps and trying to prove that package pickers hurt us.

- Popup and Form Builder no longer featured in BigCommerce? https://www.bigcommerce.com/apps/

- Wix Payment buttons now available via Add Element panel

- Pilar will set up a Zendesk trigger to send these updates to Slack: https://www.wix.com/release/notes/new-features

- Wix webhooks: missing data for Nov 13-18

- Churn: waiting on better data

All data: https://docs.google.com/spreadsheets/d/1Os1lqizy7Yzq_kzCstJfOnsAaM4AZSwrI_7Xq164Ejk/edit#gid=0

Follow up

- Why Squarespace grew?

- Why HTML going down?

- Replace NPS with Feedback from Standalone

- How people come from Wix to Powr

- Wix users missing deleted at timestamp in their apps

Nov 5, 2019:

Good:

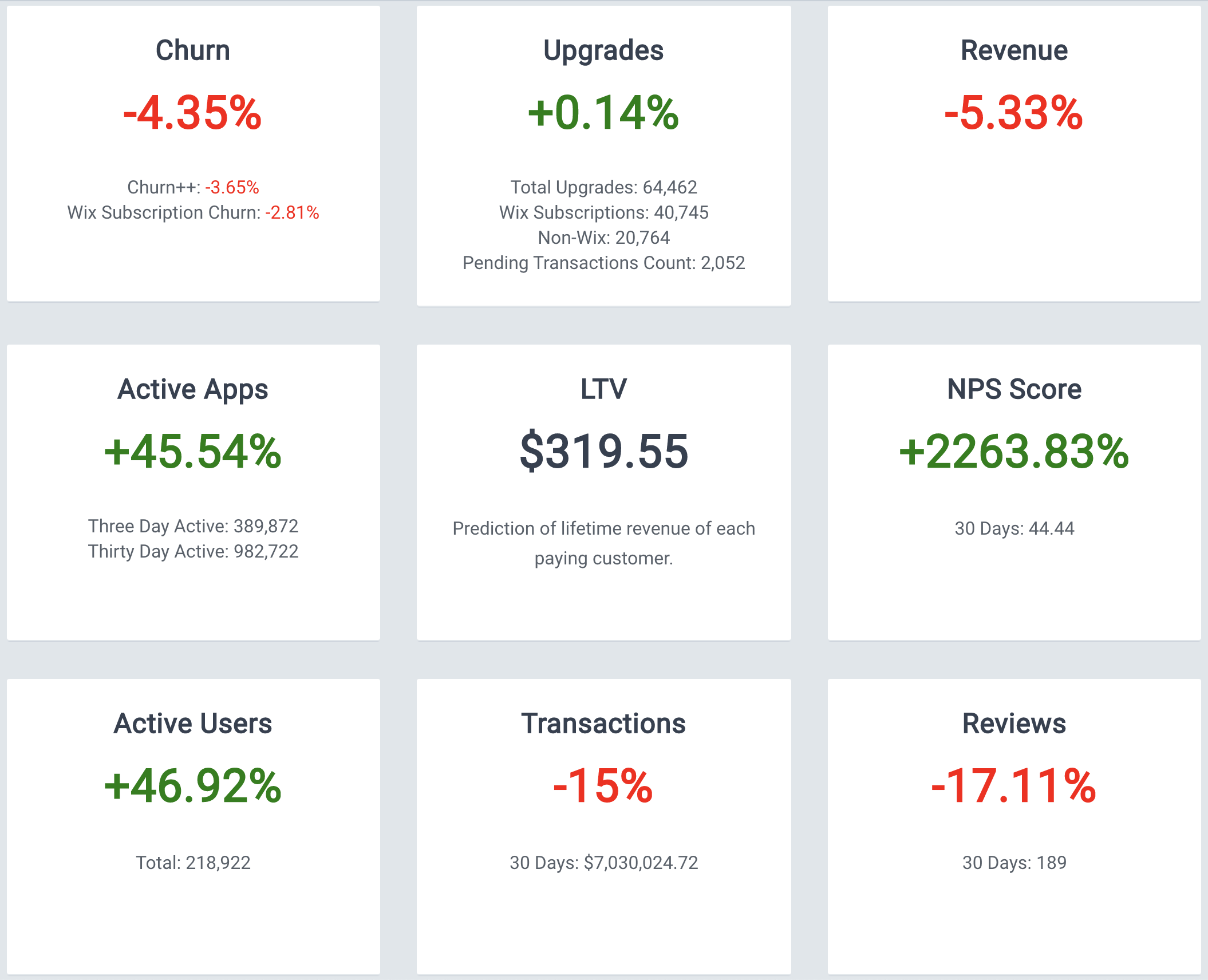

- NPS Score 44.44 (+640.67%)

- Number users paying for multiple subscriptions: 1,045 (was 852 beginning of year)

- Popup: +37.13% new subscriptions

- HTML: +14.1% upgrades

- Long tail platforms volume small but growing

Interesting:

- https://docs.google.com/spreadsheets/d/1GR36Dxx4nuFodNFLFUkivInqoeDp7YPAP83CkyiDZ_8/edit#gid=0

- Shopify uninstall ratio by app

- Churn 4%??

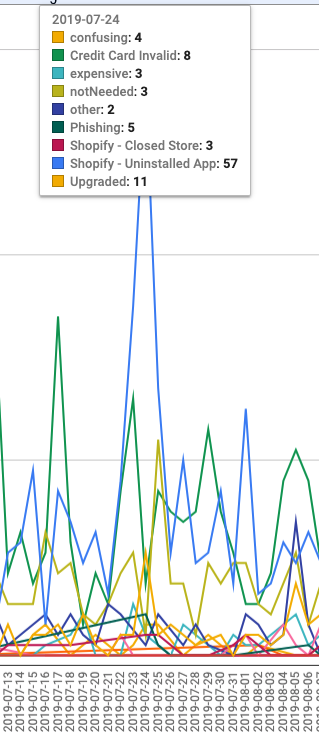

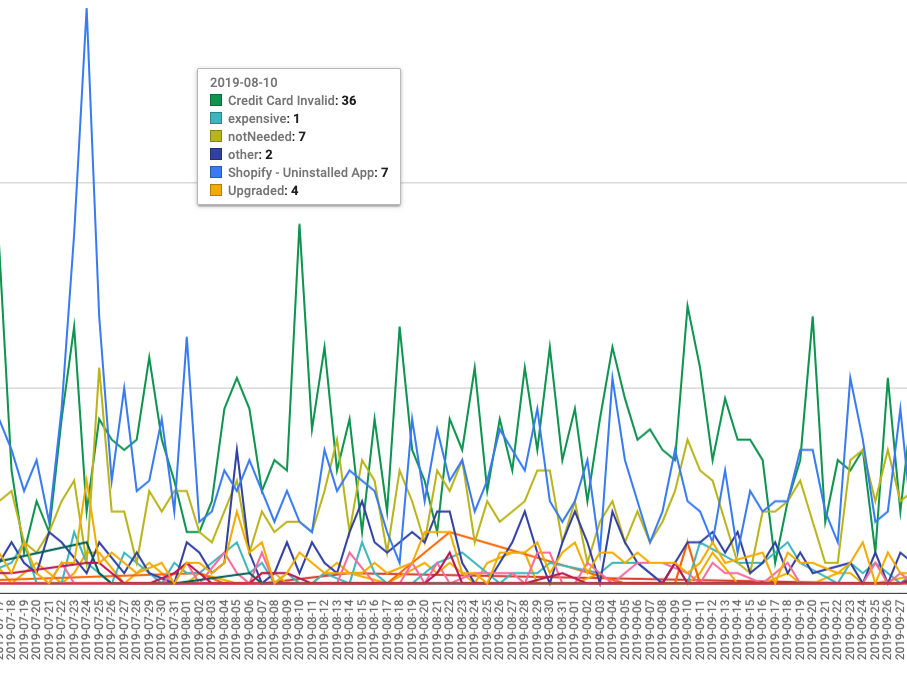

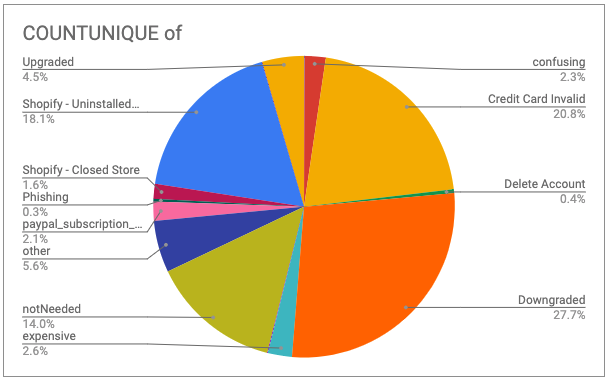

- Cancel by reason over time in absolute numbers?

- Text notifications: Total text messages sent in last 30 days: 30 Total upgrades users that have had successful payment since being sent a text message in last 30 days: 15

- Are we sending 4 letters to everyone?? https://www.powr.io/admin/snail-mails

Bad:

- Review count is still poor and not changing. What have we done? What else can we do? https://www.powr.io/admin/reviews?platform=&start_date=2019-09-05&end_date=2019-11-05

Oct 23, 2019:

Follow-ups from last Shallot:

- Look into activations drops (time series) (Ivan)

- File app innovation session (Innovation team)

- Look into JImdo combining data on powr by platfrom (data school)

- Look into creating upgrades report for Wix (Ivan)

- Waylon is not receiving NPS feedback (Emilie)

- Look into revenue falling down (data school)

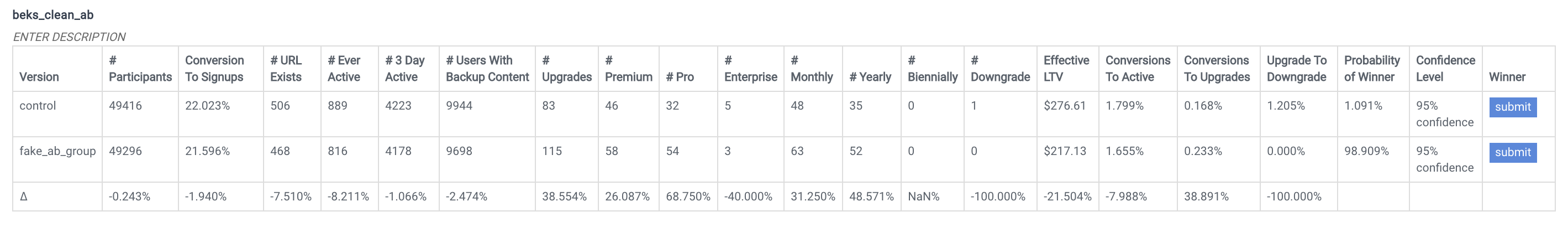

- Rerun clean abs 5-10 more times (Beks & Ivan)

- Look into activations dropping, maybe bug with Rapidload (Ben & Ivan)

New things:

- Wix upgrades peaked on September 5th at 40,214 upgrades. Currently down to 40,057.

- POWr upgrades still increasing. Currently up to 22,000

- Wix churn has been nearly flat, while other churn measures have been decreasing since around September 16th.

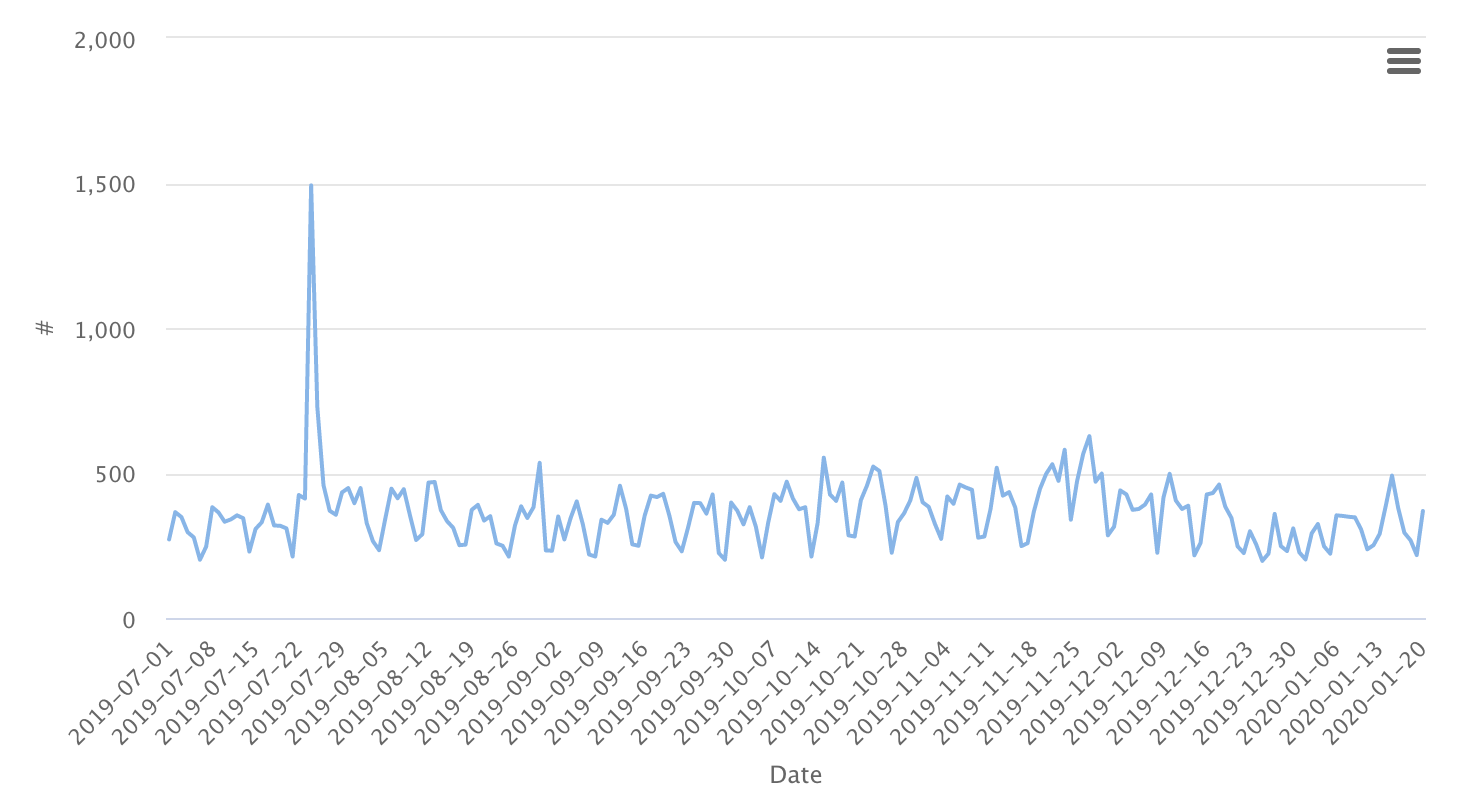

- Shopify Uninstalled App spike on July 24th, 2019 coincides with Rapidload v2 release and bug (incorrect apps appearing on users' websites)

- Credit card invalid consistently one of the highest sources of churn over the past quarter

- Downgraded - almost entirely from migration of app_subscriptions to pro_subscriptions

- Credit Card Invalid and Shopify Uninstalled App continue to be the two highest sources of cancel_feedbacks

- Not Needed - Significant 4th place at 14% - Why don't our paying users need us anymore?

- Reviews are still dropping - What do we have in the pipeline to increase (positive) reviews?

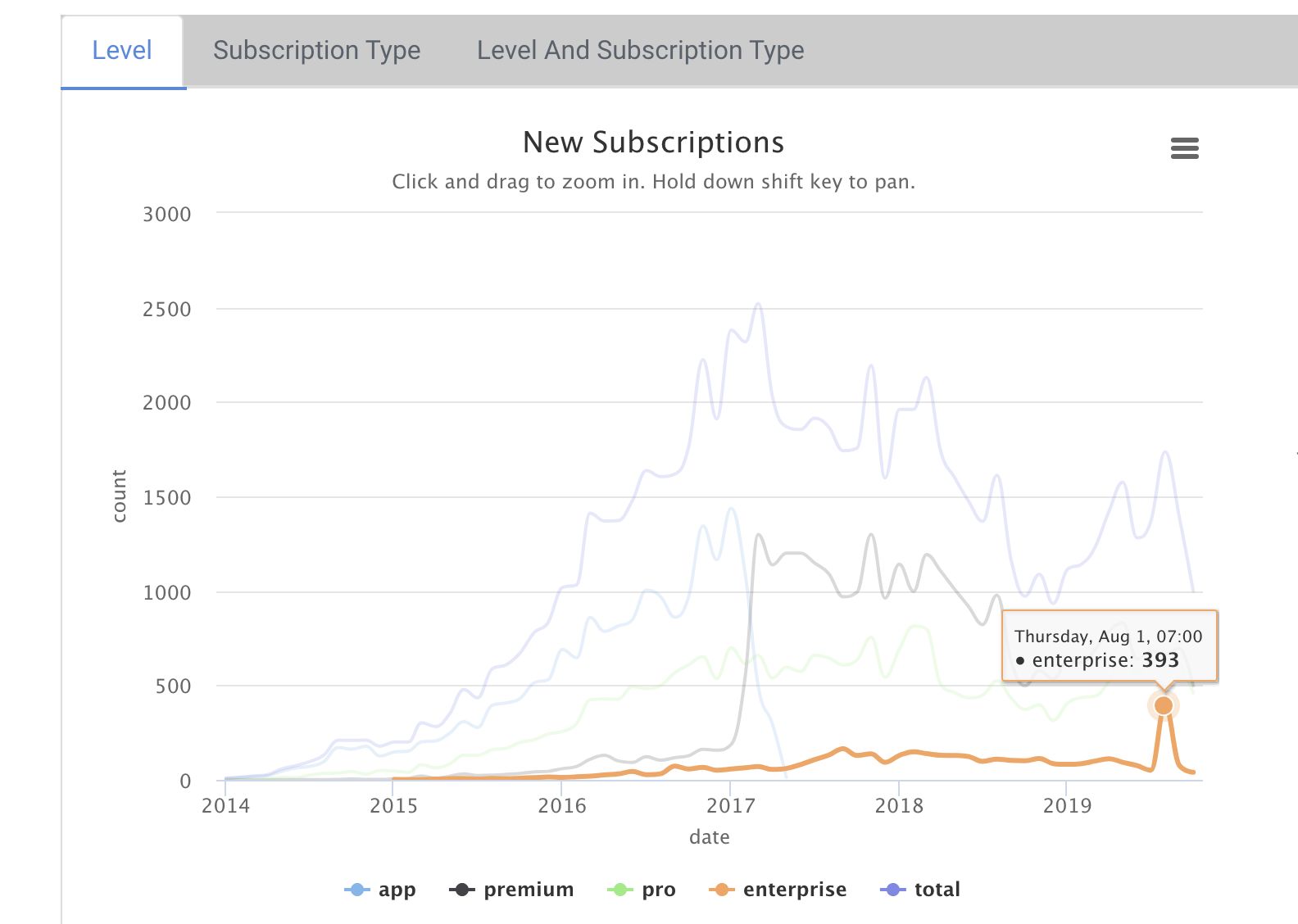

- Where did all of our new enterprise subscriptions come from in August? Are these the lifetime deals?

- Platforms with more than $1000 for Total charged are almost completely red in New Created Apps % column. Why is it happening?

- N of new Social Feeds is trending now (Overhaul was released on Oct 9th).

Follow-ups

- Look into Wix cancel_feedbacks (Why is Wix churn behaving differently from other churn?)

Oct 2, 2019:

Follow-ups from last Shallot:

- Form Builder: # of subscriptions is down because of Drama A/B (more revenue, fewer upgrades)

- Jimdo-integrated: fixed bug that caused all Jimdo users to have 'jimdo' as platform

- Pilar to look into Braintree account updater -> Looked into, is still saving us about 30% of customers with failing cards: https://docs.google.com/spreadsheets/d/1x4J4d-2xVsCk5cH9CTygfQwnxHt2q1nnYAcV7oxItl4/edit#gid=2096995166

New things:

https://docs.google.com/spreadsheets/d/1tqCKEV4x4Z8x2zdRRFFX6HUTAnP1ngmPkgx4OCHImO4/edit#gid=0

- OKRs: We only reached our Revenue goal. Way off with the other ones.

- Revenue trending down (on /numbers) - probably because Lifetime Deal was included in last month's numbers? Also, is Wix revenue included in this number?

- powr-by-app:

- URL exists and Ever active are all red, do we trust these numbers?

- File Embed: Now in the Top 5 in terms of "New saved Apps" volume. Worth an actual overhaul, or are people just not willing to pay for this product?

- Popup: new subscriptions down, Aidana is investigating

- powr-by-platform:

- Shopify new saved apps down - why?

- Lightspeed new saved apps also down - why?

- Jimdo: looking great, new saved apps has tripled since we added more apps to their editor

- Wix - do we need a separate dashboard for Wix upgrades by app/level, churn, installs, etc.? Right now, only have total # of upgrades and churn on company_goals page. # of upgrades seems to be trending DOWN.

- NPS: some great feedback, lots of bad feedback - is new flow going to help with this? https://www.powr.io/admin/nps-wobbly-generator?ratings=all&tier=all&start_date=2019-09-01&end_date=2019-10-01

Discussion points

- Shallot/Onion schedules (product team taking a one week break from sprint planning)

- Clean AB results

Follow up

- Look into activations drops (time series) (Ivan)

- File app innovation session (Innovation team)

- Look into JImdo combining data on powr by platfrom (data school)

- Look into creating upgrades report for Wix (Ivan)

- Waylon is not receiving NPS feedback (Emilie)

- Look into revenue falling down (data school)

- Rerun clean abs 5-10 more times (Beks & Ivan)

- Look into activations dropping, maybe bug with Rapidload (Ben & Ivan)

Sept 17, 2019:

https://docs.google.com/spreadsheets/d/1IE9geC6Wqq6O0zP84lbLNRJnhtZNGoHimd_K7gibNzU/edit#gid=0

powr-by-app:

- File Embed new apps up 38% (likely Weebly)

- Photo Editor new apps up 16% (likely Wix)

- Countdown Timer new subs up 33%

- Social Media Icons new subs up 127% (57)

- Form Builder new subs down 24% (new apps down 6.5%).

powr-by-platform:

- Jimdo new subs up 90%

- Jimdo-integrated has 193 new apps (went live 09/11).

Concerns:

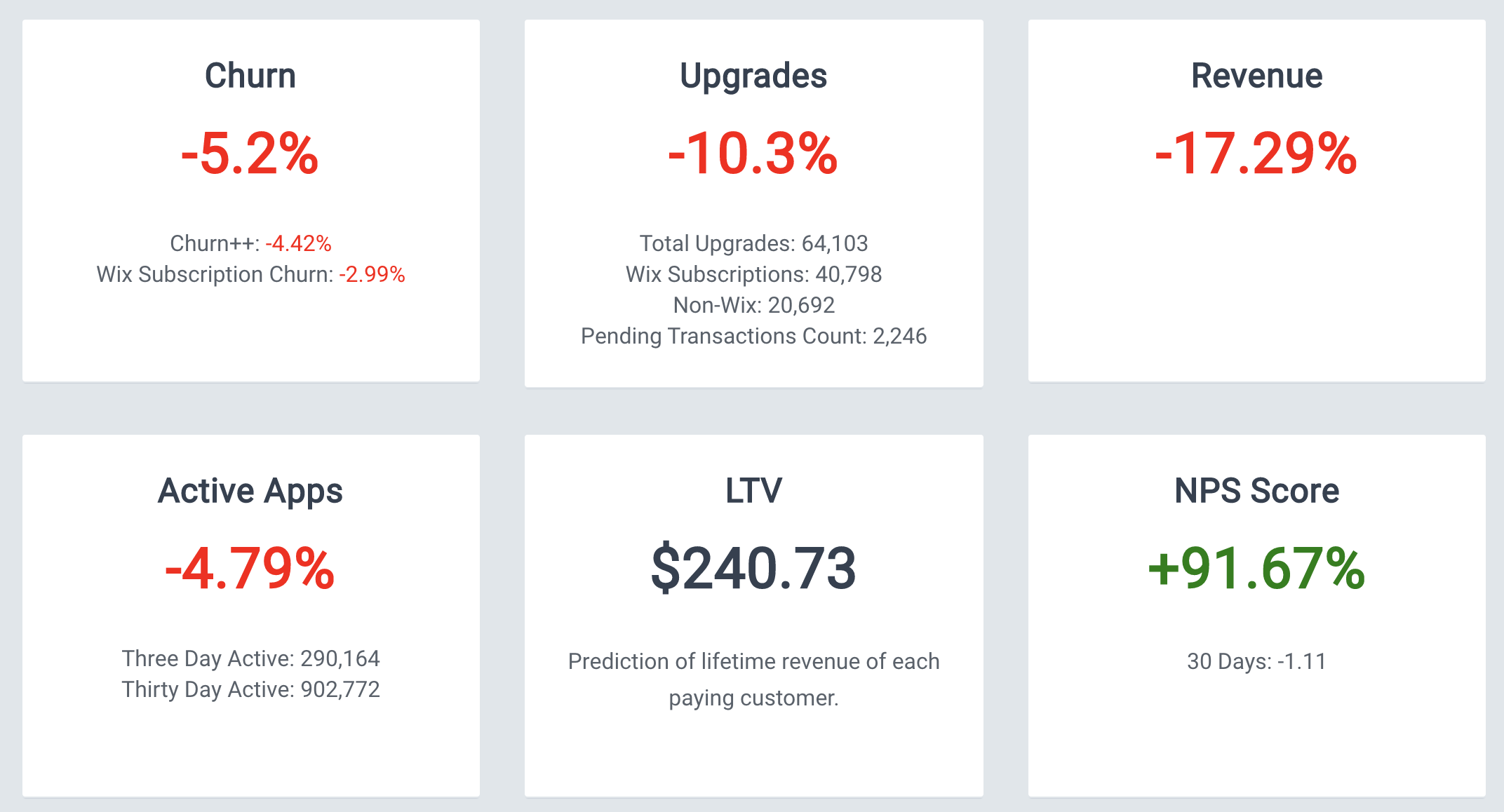

- LTV is down $240.73 (this is because of churn going up)

- Churn is at 4.75% (all POWr).

Churn research:

BigCommerce Partner Program:

Doesn't seem to be yielding great results in terms of installs:

Tutorial Landing Pages:

Follow ups:

- Form Builder new subs down - look into in Data School

- Ivan to check dashboards and separate out jimdo-integrations

- Pilar to look into Braintree account updater -> Looked into, is still saving us about 30% of customers with failing cards: https://docs.google.com/spreadsheets/d/1x4J4d-2xVsCk5cH9CTygfQwnxHt2q1nnYAcV7oxItl4/edit#gid=2096995166

- Churn follow up in data school

- Ivan to follow up on Shopify churn (Shopify plan type)

Sept 4, 2019:

Good things: Upgrades +33.8% Rev +25.6%

Wordpress +65.38% Weebly +22% Shopify Flat

NPS at 0!

Concerns: Form Builder -10% new apps and upgrades

Churn High AF: 5.15%, churn ++: -4.36 Reasons: Shopify uninstalled app Credit card invalid Not needed (Expensive 41)

Reviews: Trending up but still way down from where they were (250/day to 125/day) https://www.powr.io/admin/reviews?platform=&start_date=2019-06-04&end_date=2019-09-04

Followups:

- Look at Shopify on per app basis (Data school)

- Form Builder -10% new apps and upgrades (Teddy + Data school)

- Ivan to remove LTD from subscription calculations (Ivan)

- Plot of churn reasons over time (Ivan)

- Dunning session (Step 1: Ivan overview what are we sending and any data on what is working. Step 2: schedule dunning sess)?

Aug 21, 2019:

Action items from last Shallots/things to look into for Aug 21 Shallot:

- Look into where Social Feed is growing

- Shopify churn research + ask Brian for more info

- Squarespace growth

- Chrome: figure out what those installs really are

Aug 7, 2019:

powr-by-platform

- BigCommerce: numbers are not looking so hot. Top of the funnel is down, but new subscriptions are also down. We'd expect revenue to be trending up because of the pricing A/B, but so far we are not seeing that.

- Squarespace: should look into why it's looking so good this month

- Bookmark: seems to be tanking BUT a lot of our Stackcommerce upgrades are from Bookmark users:

- Speaking of Stackcommerce, we spot-checked some of the platform-less accounts and found a lot of users that never published our plugins or installed them anywhere.

- HTML: All numbers going up. Need to look into how these users are finding us. Things we already investigated:

- Edit > Install flow: no weirdness there, HTML only gets assigned if user chooses it, or if they successfully install using the Embed Code

- Traffic to HTML tutorial landers also doesn't seem unusual:

- Chrome: are people really finding us through https://www.powr.io/tutorials/how-to-add-pinterest-feed-plugin-to-your-chrome-site ? Monthly revenue is high this month despite very low volume.

- beyond_shop: should this be a separate platform in our db?

- Ever Active Apps: why is this red across the board?

Rapidload Technology:

- Cancellations tripled during Rapidload bug:

- We verified that these cancellations were related to Rapidload by looking at the uninstall history in Shopify and reading through the comments (which you can see here highlighted in yellow: https://docs.google.com/spreadsheets/d/1Hi-O8VhICVmfe2yCAVMZPvz-7UN1vaIQuBf-gRMJk5I/edit#gid=1552093075 )

- This is the impact of Rapidload on Popup:

- Form Builder cancellations were also slightly up in that timeframe, but mostly because of phishing forms.

powr-by-app:

- Form Builder aliases

- Consider creating custom landing pages for aliases that are generating more than $1000/month in revenue

- Prioritize aliases that are generating any revenue for templates in the upcoming template mini market

- What do do with worthless templates? (No saved apps, no revenue)

- Social Feed is growing even though everything else is flat. Need to look into where growth is coming from? (Possibly because of new aliases in Weebly and Shopify?)

- Map is growing. We need to fucking fix it.

- Chat: volume is good but churn is awful

Follow up items from last Shallot:

- Shopify churn is still high - why is this? -> looked into a little bit. 80% are automatic downgrades because of uninstall, 5% are because of store closing. We should do a deep-dive into which plugins, after how many months do they cancel, etc.

- Emilie & Shannon to look into NPS flow + optimization

Action Items:

- Look into where Social Feed is growing

- Shopify churn research + ask Brian for more info

- Squarespace growth

- [Created Jira ticket for updating the Embed Code to ?platform=embed] HTML top of funnel growth

- [Added to Innovation roadmap] Map & Chat research on Innovation roadmap. Link to support tickets:

- Chrome: figure out what those installs really are

July 23, 2019:

- Numbers are down but seems like this is mostly due to seasonality.

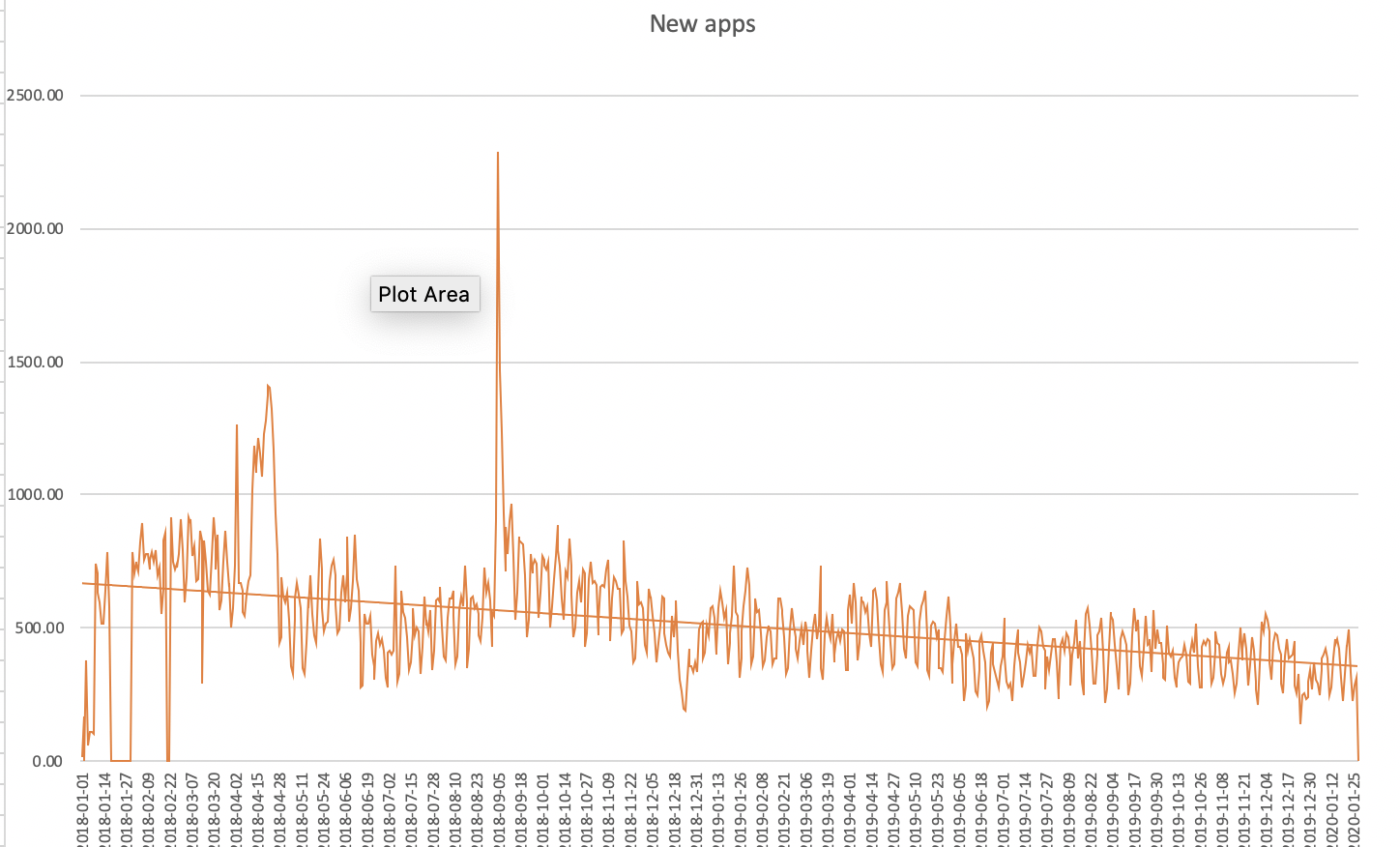

- Upgrades are still declining. Highest level was around March 2018 and we have not been able to get back to that volume:

- Upsell $5 promos are not currently doing anything. Only 1 promo code redeemed out of the 280 created. Only 9 users have visited www.powr.io/unlimited.

- NPS score is down -25.54% - What can we do?

- Can we intercept feedback before NPS? Hotjar?

- Emilie + Shannon to jam on triggers + flow.

- Brian from Shopify mentioned that they are seeing decline in numbers their end - we should expect them to pick up around September. Helps explain decline in upgrades.

- Form Builder has been at position #4 in Customer Support category in Shopify since July 16. No resulting bump in page views though so this section is not helping us:

Biggest bumps occur when we're in the top 4 'trending' apps e.g. Social Feed:

Biggest bumps occur when we're in the top 4 'trending' apps e.g. Social Feed:

- Countdown Timer page views have been declining since fake Beeketing, but good news is they will be out soon:

- Ivan demo OKRs 😊

July 10, 2019:

Good things

- Users paying for multiple subs on the rise: https://www.powr.io/admin/multiple_apps?start_date=2019-01-01&end_date=2019-07-01

- Bigcomm, Wordpress, Squarespace, Bigcartel on the rise

Things that need attention

- Employees are out of date

- What's up with these pages: https://www.powr.io/admin/downgrades-and-billing-frequency-changes?start_date=2019-06-10&end_date=2019-07-10 https://www.powr.io/admin/cohort-trends?start_date=2019-12-01&end_date=2019-07-01&platform=all&app_type=all

- New subscriptions seems to have tanked in june: https://www.powr.io/admin/upgrades?start_date=2019-01-01&end_date=2019-07-10&platform=all&app_type=all

- Based on this, seems like it is multiple platforms, led by shopify: https://docs.google.com/spreadsheets/d/1u1S8EZ_0qbqheaIKxpzhzYWfkCtbvyCiPvFkmvUvcwg/edit#gid=1357201275

- Need to prioritize why is shopify tanking

- Why does this not load? https://www.powr.io/admin/shopify_app_store?app_name=All&category=All&subcategory=All&start_date=2019-01-01&end_date=2019-07-01

- Based on this, seems like it is multiple platforms, led by shopify: https://docs.google.com/spreadsheets/d/1u1S8EZ_0qbqheaIKxpzhzYWfkCtbvyCiPvFkmvUvcwg/edit#gid=1357201275

- Jimdo tanking, let's get out improved integration ASAP

June 16th, 2019:

Action items:

- Look into Wix churn

- Draft departmental OKRs ready by Wednesday 11am.

- Top of funnel: Slider, Gallery, FAQ -->

In Progress:

- Don't let users upgrade an app for which they don't have an active install --> in current Sprint

- Defaulting to FB on /pricing: Only do that if the user has no saved apps --> in current Sprint

- Figure out if single_app Business (Wix pricing model) might make more sense for Shopify users --> low-pri, Pilar will look into

- Figure out why churn was so high in March --> Pilar to look into for Q2 Funion

June 12th, 2019:

- Annual subscriptions with and without discounts: https://docs.google.com/spreadsheets/d/1dIKUo4dE9lKsQV32bm-tLmOPqydd4iZe95ZX_wqJ6xc/edit#gid=1709641346

- Key findings:

- Majority of cancellations after year 1 are due to "Credit Card Invalid"

- The ones that aren't are a combination of "no longer using on website" and "didn't know this was going to renew

- Original hypothesis: higher discounts will have a cliff where yearly users choose to cancel around the time of their renewal

- Hypothesis did not hold. Higher the discount amount, the greater the overall retention. However, Credit Card Invalid cancellations spike

- Action items?

- Find out what those "Credit Card Invalid" downgrades are (user disputing charge? pre-paid credit card? not enough funds in account? credit card expired?)

- DON'T offer a discount to all users on renewal. Instead, identify likely to cancel users and incentivize them to stay by giving a discount.

- Key findings:

- Shopify Churn followups:

- Billing bug turned out to be a product bug

- Here's what was happening:

- User installs FAQ. They love their FAQ! So they go to powr.io/pricing. They have no reason the assume that the pricing they are looking at is for anything other than FAQ, so they buy whatever is there. Now they have Form Builder Starter.… "Why's my FAQ not upgraded? This is bullshit. I'll uninstall" --> Form Builder upgrade gets cancelled.

- Or: User installs FAQ. Upgrades to Business. Starts using other apps. Uninstalls FAQ --> Business upgrade gets cancelled.

- Action Items:

- Don't let users upgrade an app for which they don't have an active install

- Defaulting to FB on /pricing: Only do that if the user has no saved apps

- Figure out if single_app Business (Wix pricing model) might make more sense for Shopify users

- P1 Apps:

- Gallery and Slider aren't growing at all: https://docs.google.com/spreadsheets/d/1SCpjz_8BlGQhpc3uWMKZhhBunymY20Mz5j5Ug4Wb6Iw/edit?usp=sharing

- 60% of Slider & Gallery upgrades are from Shopify users

- 50% of Popup upgrades are from Shopify, trend being that Popup is growing more inside Shopify than outside of Shopify

- Social Feed:

- Social Feed is an outlier in many ways: top platforms are HTML, Jimdo, Weebly, Shopify

- Top of the funnel is looking great AND is primarily through SEO and smaller platforms

- Churn is among lowest of all apps

- BUT: Conversion to paying is disgustingly low

- Action item: put the new KZ PMs on making this plugin more competitive

- Gallery and Slider aren't growing at all: https://docs.google.com/spreadsheets/d/1SCpjz_8BlGQhpc3uWMKZhhBunymY20Mz5j5Ug4Wb6Iw/edit?usp=sharing

- New Platforms:

- WordPress site builders have some volume.

- Total revenue for new platforms combined is < $450

Action Items:

- Figure out why churn was so high in March

- Top of funnel: Slider, Gallery, FAQ

- everything from above

May 29th, 2019:

Action items:

- Pilar looking into Shopify churn; Emilie to pair on top of funnel.

- Pilar and Ivan pairing on active conversions

- Emilie to sync with Raven on following up with NPS detractors to get more feedback.

- Ivan to report back on new apps created - is there a correlation with spike in new users?

- Upgrades +9.21%

- Shopify churn is high. Can we do anything about that?

- Majority Countdown Timer, Form Builder and Popup (these are also most popular apps).

- Shopify URL_exists down almost 96%; Page views are down almost 13%; Events down +16%.

- Countdown Timer: ~25% installs compared with last month. Haven't lost our search position in app store:

- Popup = ~30% installs

- New saved apps and installed app numbers (both by app and by platform) are down significantly: https://docs.google.com/spreadsheets/d/1pVXmvZ0fihLvU-gIa4R5sHkjeGFe4jeBdnklaxKb7xo/edit#gid=1710908615

- NPS score: -10.69. Main complaints:

- Doesn't work

- Bad support

- Billing/pricing issues

- New user growth is up since end of April 2019 (doesn't look like it's seasonality):

- The spike comes from 'unknown' platforms - this isn't related to standalone being embedded on tutorial pages. We're not seeing a spike there. What else did we do?

- Tutorial landing page sessions are going back up with page speed improvements:

- Bounce rate is also substantially better:

May 15th, 2019:

- New subs up in April:

Popup: 92% Slider: 18% Microblog: 40% Weebly upgrades down 15% Blank platform up 50% (probably because of install flow) Outside of shopify -7% in upgrades :(

- Tutorial landers looking bad since integrating standalone. Get an image on there or load on scroll

- Users with multiple app types: https://www.powr.io/admin/multiple_apps?start_date=2018-05-01&end_date=2019-05-01

- Devis report on refunds

- Almost 24K YTD.

- Majority are on renewals

- Update policy to not refund on renewals?

- Pro-rated discount on upgrades? E.g. user purchases wrong app. Give them credit for future purchase.

- How many people had a successful renewal when they upgraded using a discount?

April 17th, 2019:

- Why is our churn going up?

See separate presentation in Shallot folder

2. Why is Wix churn going up?

- Churn is going up vs. previous months, however it appears to still be lower than this time last year.

- Webhook data is not available before 5/2018, so we need to compare overall Wix churn from this Jan-Apr with overall Wix churn for Jan-Apr last year.

- January of last year was the highest churn of the year, February a close second, with relatively steady decreases for remainder of year

- Need to keep an eye on this, Increasing churn in Feb and March is concerning.

- As we come out of May, it will be important to see how our cancel_immediate and cancel_requested look compared with last year

3. Why is our number of pending transactions so low at the moment?

- ~2k (usually is around 3k)

- What we looked into is if this is due to success of auto wobbly texter or whether there were any bugs with setting transactions as 'pending'.

- What we found is that this is also related to the new Shopify downgrade logic. Instead of putting Shopify users who have uninstalled or closed their store in the regular 3-month dunning flow, we now downgrade them like a regular cancellation. This means that the number of pending transactions is going to continue going down as more and more Shopify subscriptions fall into the new flow. (Currently, 826 out of 1978 pending transactions are Shopify)

- We will have a much better understanding of the impact of "Credit Card Invalid" downgrades once this is fully cleaned up!

4. Why is Slider churn so bad?

- As seen during the Funion, Slider churn has been bad since Reactification. (up 98% compared to before, numbers excluding Shopify)

- Looks like this is actually just an issue with the Conversion Comparison page counting upgrades to higher plans as "downgrades";

5. Why were Pro upgrades up so much in October?

- Follow up:

- Tutorial landing pages language data: https://docs.google.com/spreadsheets/d/1t0QOSjLUQSKZrtJBNeCiQypPViDPA9iOSMztcGwE1y8/edit?usp=sharing

April 2nd, 2019:

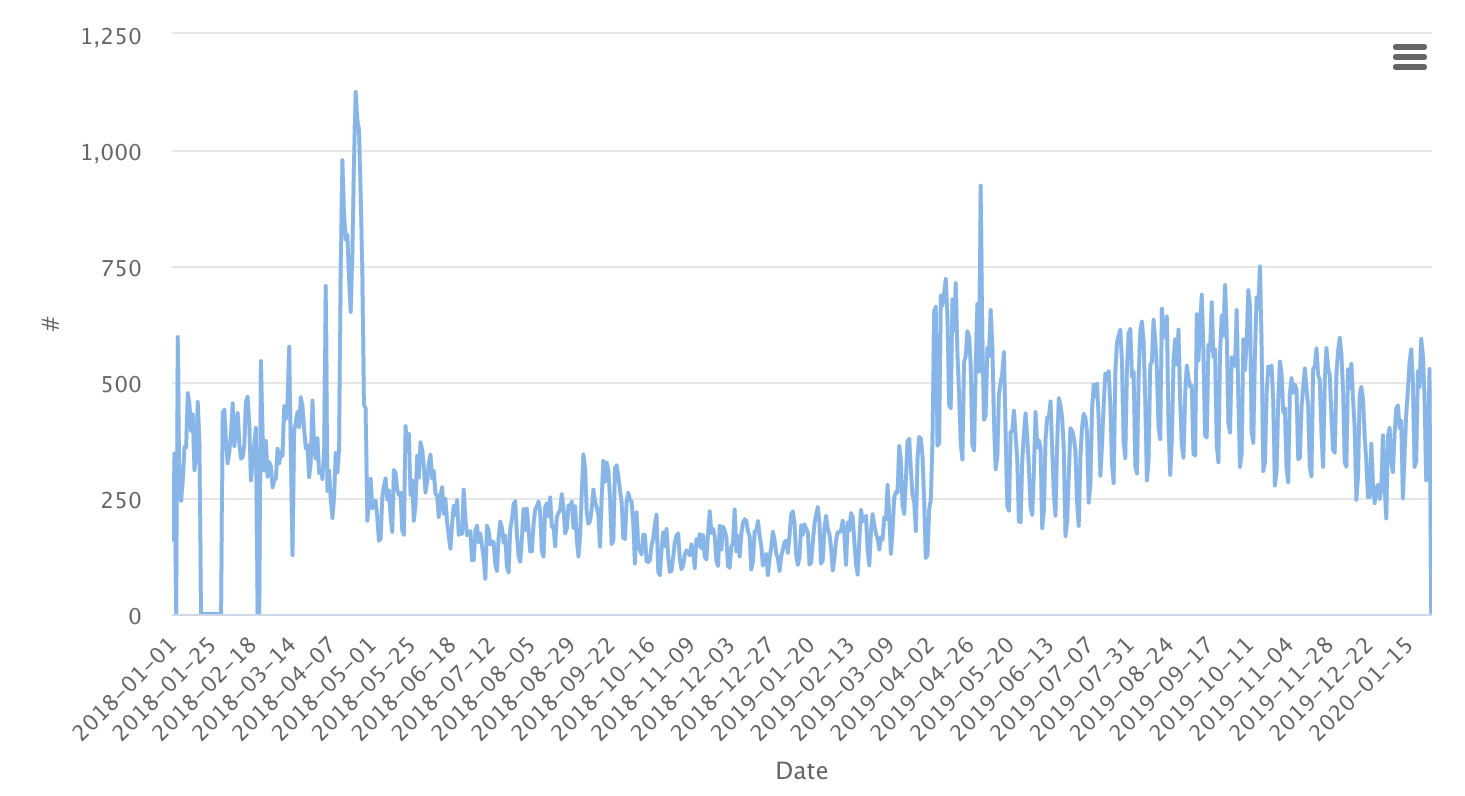

- Wix new users have been going down from beginning of 2018 to now. Why? What can we do?:

- Shopify new users went up after freefall (and new app store launched). There was a big spike in January.

- HTML users had a decline in August 2018, but seems to be stabilizing again.

- We're doing a lot better with retention. This is particularly noticeable with 90 day retention. We saw the switch around the time we switched to yearly. Are people also seeing more value? We launched 'Add Name + Billing Address to our checkout' also?

- By-platform question: What is the difference between Google and Google-sites? Why is this not showing up in list of platforms?

- Monthly rev for top platforms (ignore Wix):

- Emilie and Pilar to work on translating Lightspeed app store listing + add to Shopify.

- Emilie to look at: Look at analytics for tutorials (language versions) - are they ranking? Monthly traffic? Are there sign ups/upgrades? is there a case for translating?

- Can Shopify share any metrics on non-English users and which languages they have app store listings for? Emilie to ask Jason.

- New subscriptions (ignore Wix):

- Keep an eye on NPS.

March 20, 2019:

- Blogger apps noticeably up since making free (too early to tell about upgrades): https://www.powr.io/admin/analytics?platform=blogger&app_type=all&start_date=2019-02-18&end_date=2019-03-20&method=daily_analytics

- We have nontrivial amount of Hubspot users...do they have an app store and can we get in it? Tyrone note: We have support tickets (maybe ~1 a week) where people inquire about Hubspot. We should get a feature request up.

- We lost /split numbers when Puru switched over database during sparkpost fiasco. Let's see if we can get them back

- % of pro upgrades trending upward over last few quarters: https://www.powr.io/admin/upgrades?start_date=2014-01-01&end_date=2019-03-20&platform=all&app_type=all

- Total subscriptions count still flat

- Finally (hopefully) deciding on definition of when last_viewed_at vs last_viewed_url set (determining active analytics)

- What's up with users with more than one app type (and what is this actually computing?) https://www.powr.io/admin/multiple_apps?start_date=2018-09-01&end_date=2019-03-01

- Wix churn trending up...do we need to investigate?Tyrone note: Volume of Wix tickets is trending downward

- Not anywhere near our revenue goal for the quarter. Brainstorm sessions needed.

February 20, 2019:

- /numbers: Upgrades up by 40%, but skewed due to Shopify no longer being all free (as of Feb 4). A lot of the upgrades growth might also be coming from Wix.

- If we look at upgrades (excluding Shopify) since Jan 2018 until now, we can see that upgrades have mostly been flat and January growth does not look impressive:

- Upgrades in general are still trending down since switching to single_app pricing in mid 2017.

- Side note on Wix: our active apps have gone down a ton since fixing our last_viewed_url. Do not be alarmed by this if you see those numbers being funky.

Other things to look into:

Other things to look into:

- Popup growing very slowly, why? (Seasonality?)

- Form Builder subscription up by 40%, but saved apps only up by 10% - existing users upgrading? conversion to upgrade improved?

- Countdown Timer and Social Feed are growing a lot at the moment, we pulled data but still need to analyze it to figure out where the growth is coming from.

Data School findings:

- We looked at why Weebly upgrades have been trending down since early 2017:

- We found a few things:

- 1) Weebly users were extremely likely to have multiple app upgrades (16% of users creating upgrades between January and May 2017 had more than 1 upgrade created within that period)

- 2) 40% of upgrades created within that period were cancelled within 30 days.

- The pre "Kill Instance" upgrade numbers were inflated because of the duplicates, and most of those were not high-quality, loyal wobblies.

Updates on A/Bs:

- https://www.powr.io/admin/powr_ab?ab_name_active=promotional_popup_deal&start_date=2019-01-09&end_date=2019-02-19 Credits and Discounts seem to generate the same # of upgrades, but credits users downgrade immediately. This seems to be in line with what Ivan found regarding Rewards program. Can we dig into this a little more?

- Billing Cycle + Upsell need script

February 6, 2019:

- Pilar - add Instapage tutorial; Nationbuilder - who are they?

- Map users - did Tyrone find anything here from aggregating support requests or reaching out?

- No emails if save and app but don't select a platform - Emilie to look into (how many of these users do we have? + users who sign up first before creating app).

- Ivan to check number of users who created an app but didn't create an account.

- Check NPS in ~1 month when we're not seeing pollution from 'Rate POWr' link in website footer.

- Ivan: we'd like same churn graph for 2019 as we had for 2018 to look at for Shallot. Agree it would be good to look at Shopify churn separated out.

- Everybody: Think about metrics we want to track in Shallot beyond company goals.

Actions from last week

- POWr Culture doc was shared and added to POWr Outlet

- We have a functional 2019 goals page

- Daily analytics now has +/- comparison

- Emilie looked at Shopify data - turning more apps back to paid.

- HTML users - did Tyrone find anything on actual platform used using Brent's Chrome extension? https://docs.google.com/spreadsheets/d/1PAmC8RxR-9BDMpRkmg3dWOexTydncW37yeUTlSk7tWM/edit?usp=sharing

- Map users - did Tyrone find anything here from aggregating support requests or reaching out?

- Watermark redirecting to standalone:

- Watermark redirecting to standalone was changed January 8th.

- Results: https://docs.google.com/spreadsheets/d/1TmQG7SLYF5Tnav3ZPCv5gwGBHQkL2hzRy6RMiSlvSeo/edit#gid=781988706

- Sessions +82%; account creations +37%; upgrades +185%.

- Countdown Timer has the highest volume.

- https://analytics.google.com/analytics/web/#/savedreport/HLig7Gh-SNK6FF4O9aw-bg/a63593465w99177885p103161318/u._date00=20190108&u.date01=20190203&u_._date10=20181212&u.date11=20190107&r._dsa=1&2111-table.plotKeys=%5B%5D&2111-table.rowCount=1000&.advseg=&.useg=&.sectionId=/

New stuff

- We now have large volume of users who are creating apps and leaving because of Volcano flow - app numbers are all green whereas platform numbers are red.

- Discussion point: Users are saved if they hit 'Add to Site' but don't log in and affects conversion to active.

- NPS is up but still at -17.39 (trending up).

- Upgrades are up almost 25% in last 30 days. 19,530 non-Wix (down on end of 2018). Wix upgrades are up and this is driving total upgrade growth.

- Shopify: New apps up ~45%, saved apps +45%; upgrades up 41%.

- Weebly: new and saved apps up ~22%. Upgrades up to 21 in last 30 days.

- Jimdo: new apps +33%, saved apps +38%.

- Smaller platforms are going down trend-wise, but volume is low.

- PayPal Button and Form Builder active apps are down

- Chat is "poppin'" +35% active. (Beeketing got removed from Shopify on January 25th).

- Countdown Timer upgrades went up and downgrades went down. Why?

- Should we look at Shopify churn?

January 23, 2019:

- HOUSEKEEPING: Aarti will add POWr Culture doc to POWr Outlet and it will be shared in next week's Onion.

- We don't have functional 2019 goals page yet. Ivan is working on it today so we can have it by next Onion.

- Raw data for powr-by-platform has +/- compared to last 30 days, but daily analytics doesn't have it. Ivan will look into adding it to daily analytics.

- Users with HTML as platform - can we scrape their websites for more data on what their platform really is?

- Manually sanity check websites. Tyrone taking the lead. Brent has a nifty Chrome extension that detects platform.

- Comments is making us $4.4K/mo and FAQ is over $5K/mp. Popup is at $7.5K, also decent.

- Emilie to look at Shopify data and will schedule a meeting.

- Map wobblies: the ratio of new subs to downgrades is the best on the list of apps. volume is low but still. what could this mean?

- Tyrone to aggregate support tickets and see if there's anything that stands out.

- Reach out to users who have downgraded to find out why

- Reactify settings might fix the upload issue in the future.

- Social Media Icons: quite a few subs over the last 30 days, wonder what the cause is?

- Fixed position?

- Redirecting to standalone with watermark - Emilie to take a look at data for all apps

- Add inspectlet videos to that?

January 9, 2019:

- Everyone will rate their Airtable tasks and give feedback by 01/13/2019

- Need to come up with a schedule so that 2 people are responsible for reporting on numbers each meeting. Emilie will create calendar event + pairs.

- Powr by app

- Powr by platform

- Admin/numbers

- Admin/upgrades

- NPS

- Will block out a couple of hours to go over everyone's Airtable lists.

November 26, 2018:

2019 POWr goals

Valuable KPI’s Which apps to keep free? Someone figure out where microblog upgrades are coming from? Ivan

Why is form builder subscriptions down- look by app by platform Ivan

General blockers

-we did not do anything for holiday season-

- create a campaign,

-generate targeted list- measure ROI

-end of year sale?

How to track effectively?

A sense of urgency to drive sales- what is the “why?” - Winter Sale

Work out an end of year sale:

Which users do we want to target? What is the discount we’re offering? What is the urgency? Why? How do they redeem the offer? Send a blast through Mailchimp:

Work out cost What data do we need to extract from DB? How do we import? How do we link email? How to promote:

Social posts Since U Gone update? Add countdown to pricing table

Project Canary

Upgrades

Certain indicators - for when something is tanking or doing well.

Saved apps

Needs upgrades

Needs revenue

How hard to put wix update

Revenue goal

Investigate numbers up until september- ( ivan) - (get clarification)

Proactive approach

Biz dev- ask if there are any changes- (Wix)- have Josh reach out if there is a tank issue, needs to be measured so we have our own data.

Change in LTV-( Ivan ) ( heavily based on churn #’s)

Why are transactions down How do we identify?

Emilie -what do we look like in the wix-paypal platform

Josh - up the percentage of paypal-get up to 3 bips

Bring up with paypal next tie on call

Ivan: Numbers for some of the above tasks https://docs.google.com/spreadsheets/d/1njh5UqUxQkWdAMe6CVAM369Xfx45YpLRsSOZxzD87gs/edit#gid=0